Opportunities

Realized.

Find Your Financial Footing, One Step at a Time.

At Key Private Bank, we see ourselves as your guides on a financial journey – a journey that includes the usual twists and turns, and the occasional detour. That’s why we work with you both in-person and through a robust, personalized online portal to develop and track your financial roadmap.

Understand

Asking, then listening. That’s how we get to know your needs and financial goals.

Plan

Once we understand what matters to you, we’ll develop a comprehensive strategy toward your success.

Connect

We’ll touch base with you regularly to ensure your plan is helping you reach your goals.

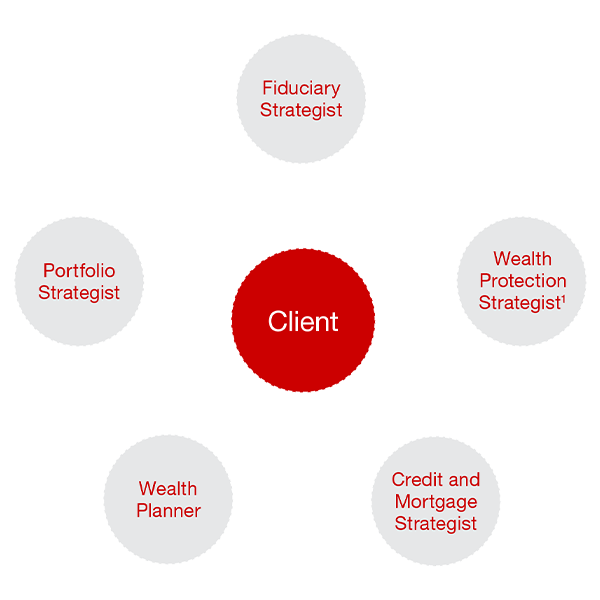

Building Wealth Takes a Team

Building Wealth Takes a Team

This is a circular graphic listing the various parts of the Key Private Bank Team and how they work with clients.

Outer circle in clockwise order.

- Fiduciary Strategist.

- Wealth Protection Strategist*

- Credit and Mortgage Strategist

- planning Strategist

- Portfolio Strategist

Inner circle in clockwise order

- Relationship Manager

- Client Experience Manager

- Wealth Advisor

At the very center of graphic is a red circle with the label "You" in bold white letters.

Led by your Relationship Manager, a team of specialists will spend time understanding the needs of you and your family, and provide you with tailored advice and a broad array of solutions.

Doing today and planning for tomorrow, is tough to do alone.

Our family's foundation represents our vision. We need a strategy.

I need a team of experts who are also tech savvy.

How are you staying current on research and trends?

Your life is constantly changing - you need financial advice that can keep up. Learn more

See Your Real Financial Picture, Virtually

Reaching your goals through a personalized, digital roadmap

Key Wealth Direction is a revolutionary financial planning platform that offers qualified clients a secure, online portal featuring a comprehensive, aggregated view of your financial assets. Along with accessing your wealth plan through a personalized website, you’ll have your Key Private Bank team at your fingertips to provide advice and guidance.

The personalized platform features:

- A consolidated view of all your accounts, including those held at other institutions

- Interactive charts and detailed views of your investments

- Tools to track spending

- A secure online vault where you can safely store important documents

Key Wealth, Key Private Bank, Key Family Wealth, KeyBank Institutional Advisors and Key Private Client are marketing names for KeyBank National Association (KeyBank) and certain affiliates, such as Key Investment Services LLC (KIS) and KeyCorp Insurance Agency USA Inc. (KIA).

KeyBank, KIS and KIA are separate entities. Each entity separately supervises the sales and other activities of financial professionals providing access to its products and services.

Services provided by KeyBank, KIS and/or KIA should not be used in substitution for independent and personal tax advice. KeyBank, KIS and/or KIA do not provide legal advice. Individuals should consult their personal tax and/or legal advisor concerning their particular situation.

There are important differences between banking, brokerage and investment advisory services, including the type of advice and assistance provided, the fees charged, and the rights and obligations of the parties.

Investing involves risk, including potential loss of principal amount invested. There is no guarantee that investment objectives will be achieved. Past performance does not guarantee future results. Asset allocation and diversification do not guarantee returns or protect against losses.

KIS, KIA and KeyBank are separate entities, and when you buy or sell securities and insurance products you are doing business with KIS and/or KIA, and not KeyBank. Insurance offered by KIA is underwritten by and the obligation of insurance companies that are not affiliated with KeyBank. When you buy insurance, you are dealing with a licensed agency, not KeyBank. KeyBank cannot require you to obtain insurance from a particular agency or with a particular insurer. Before purchasing a policy of insurance, you should compare information obtained from more than two agents. You have the right to obtain insurance from the agent of your choice, and your decision will not in any way affect KeyBank's credit decision.

1 Wealth Protection Strategists are not fiduciaries, as such, they are compensated based on insurance product sales.

Non-Deposit products are: