In 2025, KeyCorp celebrates its bicentennial, marking 200 years of service to clients and communities from Maine to Alaska. Headquartered in Cleveland, Ohio, Key is one of the nation's largest bank-based financial services companies, with assets of approximately $187 billion at September 30, 2025.

15

States

40,000+

ATMs

KeyBank and Allpoint ATMs nationwide

~1,000

Full-Service Branches

$187 billion

Assets

(as of 9/30/25)

$1.9 billion

Revenue

(3Q25)

~17,000

Full-time equivalent (FTE) Employees

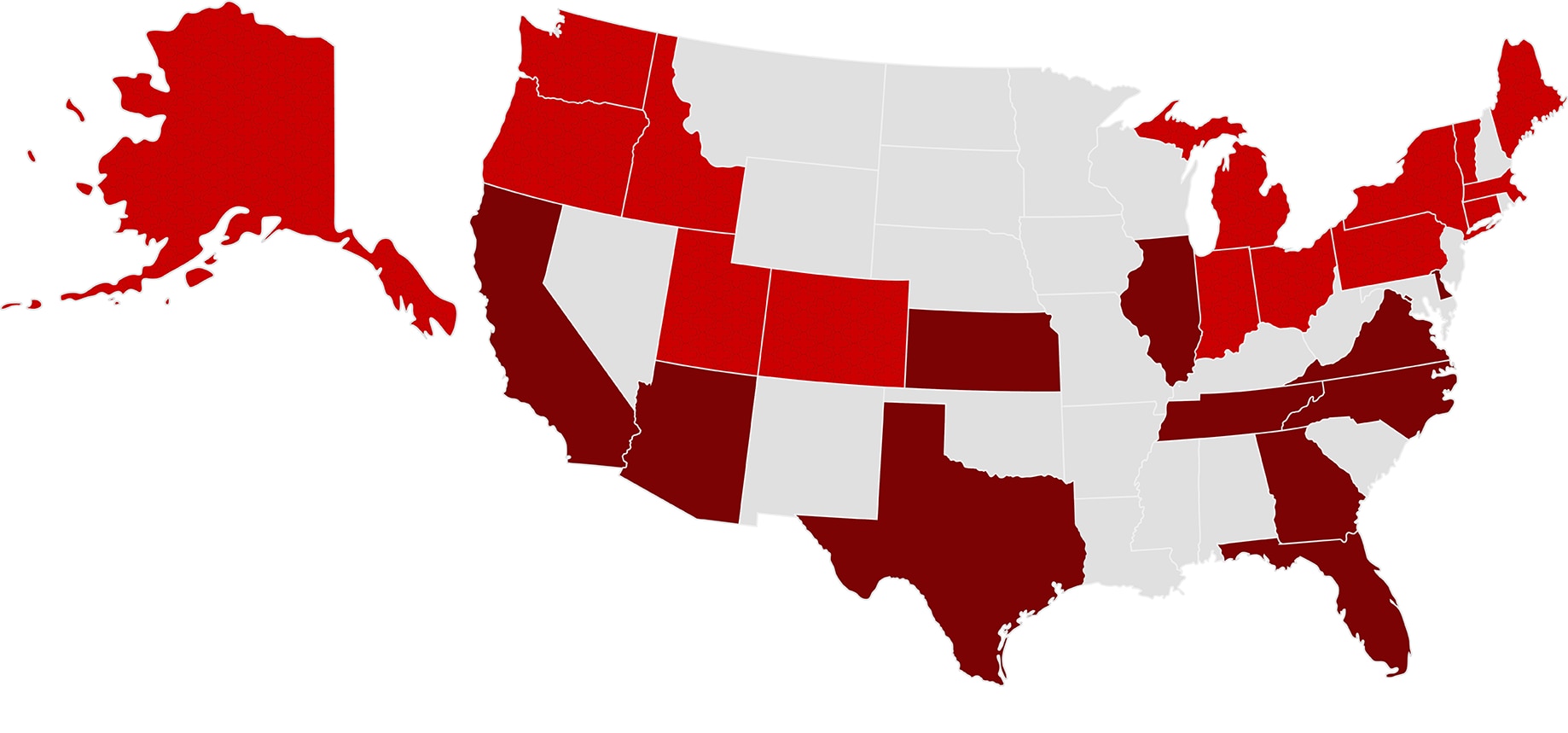

Where You'll Find Us

KeyBank is one of the nation’s largest, bank-based financial services companies, making it easy for you to bank where you live.

- Key Consumer Bank branches & Key Commercial Bank offices

- Additional KeyCorp offices

Key at a Glance

Headquarters |

127 Public Square, Cleveland, OH 44114 |

|---|---|

Website |

Key.com® |

Toll-Free Number |

1-800-KEY2YOU® (1-800-539-2968) Dial 711 for TTY/TRS Clients using a relay service: 1-866-821-9126 |

Service Area |

Consumer Banking in 15 states; Commercial Banking (offices) across the U.S. |

Financial Data

Select financial data from continuing operations for the three-month period ending 9/30/2025.

Dollars are in millions, except per share amounts.

Income attributable to Key common shareholders |

$454 |

|---|---|

| Diluted EPS from continuing operations attributable to Key common shareholders | $0.41 |

Average assets |

$187,365 |

Average loans |

$106,227 |

Average deposits |

$150,374 |

Average equity |

$19,664 |

Common shares outstanding (thousands) |

1,112,952 |

| Per Common Share | |

Book value at period end |

$15.86 |

Tangible book value at period end |

$13.38 |

Market price at period end |

$18.69 |

About Our Business

Our management structure and basis of presentation is divided into two business segments, Consumer Bank and Commercial Bank.

The Consumer Bank serves individuals and small businesses throughout our 15-state branch footprint and through our national Laurel Road®1 digital lending business targeted toward healthcare professionals. We offer a variety of deposit and investment products2, personal finance and financial wellness services, lending, student loan refinancing, mortgage and home equity, credit card, treasury services, and business advisory services. In addition, wealth management and investment services are offered to assist nonprofit and high-net-worth clients with their banking, trust, portfolio management, charitable giving, and related needs.

The Commercial Bank consists of the Commercial and Institutional operating segments. The Commercial operating segment is a full-service, commercial banking platform that focuses primarily on serving the borrowing, cash management, and capital markets needs of middle market clients within Key’s 15-state branch footprint. The Institutional operating segment operates nationally in providing lending, equipment financing, and banking products and services to large corporate and institutional clients. The industry coverage and product teams have established expertise in the following sectors: Consumer, Energy, Healthcare, Industrial, Public Sector, Real Estate, and Technology. It is also a significant, national, commercial real estate lender and third-party master and special servicer of commercial mortgage loans. The operating segment includes the KeyBanc Capital Markets platform which provides a broad suite of capital markets products and services including syndicated finance, debt and equity underwriting, fixed income and equity sales and trading, derivatives, foreign exchange, mergers & acquisition and other advisory, and public finance.

Laurel Road is a brand of KeyBank National Association.

Investment products are offered through Key Investment Services LLC (KIS), member FINRA/SIPC and SEC-registered investment advisor. Insurance products are offered through KeyCorp Insurance Agency USA, Inc. (KIA). KIS and KIA are affiliated with KeyBank National Association (KeyBank). Investment and insurance products made available through KIS and KIA are:

NOT FDIC INSURED ● NOT BANK GUARANTEED ● MAY LOSE VALUE ● NOT A DEPOSIT ● NOT INSURED BY ANY FEDERAL OR STATE GOVERNMENT AGENCY

KIS, KIA and KeyBank are separate entities, and when you buy or sell securities and insurance products you are doing business with KIS and/or KIA, and not KeyBank.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A.

Securities products and services: Not FDIC Insured • No Bank Guarantee • May Lose Value

All credit products are subject to credit approval.

NOTICE: This is not a commitment to lend or extend credit. Conditions and restrictions may apply. All home lending products, including mortgage, home equity loans and home equity lines of credit, are subject to credit and collateral approval. Not all home lending products are available in all states. Hazard insurance and, if applicable, flood insurance are required on collateral property. Actual rates, fees, and terms are based on those offered as of the date of application and are subject to change without notice.

NMLS #399797. Equal Housing Lender.