Key Moments in History

KeyBank has survived the highs and lows of two centuries. Yesterday, today, and tomorrow, KeyBank will be here.

Today, KeyBank is one of the nation’s largest financial services companies. Formed in 1994 through the merger of Society Corporation and KeyCorp, our roots trace back to a time before electricity lit the night, before the automobile ruled the roadways, and before the telephone carried our voices across the continent. Our story begins in 1825 in Albany, NY, when the first steam ships traversed the Atlantic and the Great Lakes.

See our Story

Scroll through our timeline and follow Key from 1825 to today.

1776

The United States is founded

The Second Continental Congress signs and approves the Declaration of Independence.

Source: "Courtesy of U.S. Capitol, artwork by John Trumbull"

1791

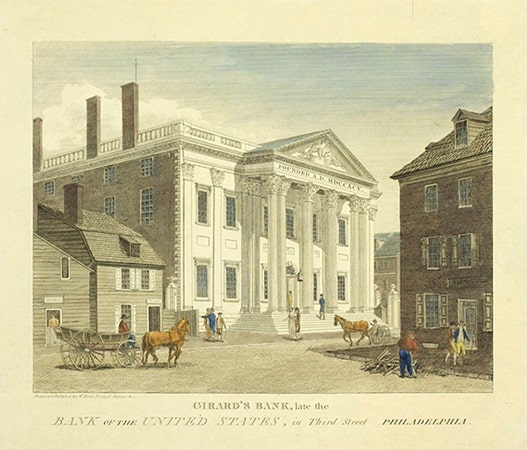

America’s first national bank is chartered

Congress charters the First Bank of the United States, in Philadelphia, for a 20-year term.

Source: "Courtesy of Library Company of Philadelphia, artwork by Andrew T. Hill"

1825

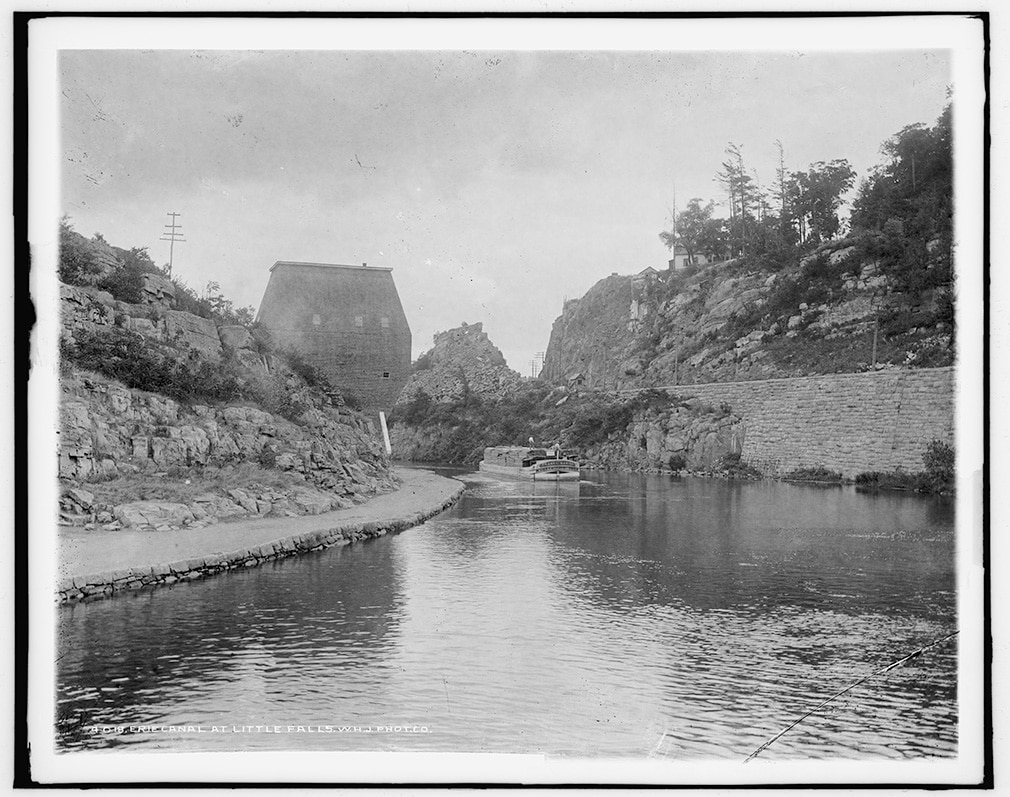

The Erie Canal is completed

The Erie Canal becomes the first navigable waterway connecting the Atlantic Ocean to the Great Lakes, vastly reducing the costs of transporting people and goods across the eastern United States. This sparks new opportunities for growth across the region, spurring expansion in cities such as Albany, Buffalo, and Cleveland.

Source: "Courtesy of Library of Congress Detroit Publishing Company Photo Collection, photo by William Henry Jackson"

1825

The Commercial Bank of Albany is chartered

Coinciding with the opening of the Erie Canal, the Commercial Bank of Albany is established on April 12, 1825. In an era when many banks primarily serve the wealthy elite, the Commercial Bank of Albany welcomes the business of individual merchants, traders, and small shareholders.

Source: "Courtesy of KeyBank Corporate Archives"

1837

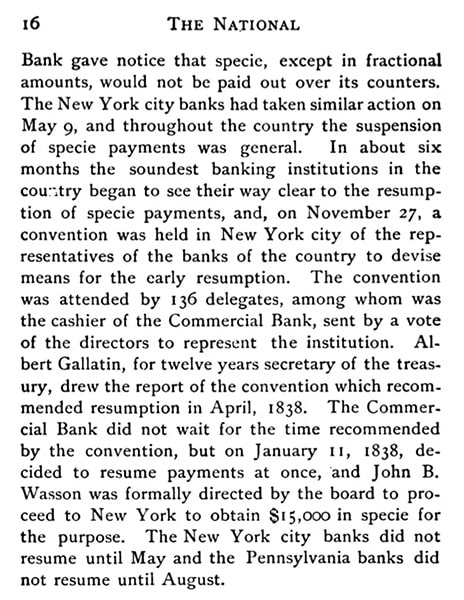

Perseverance through the “Panic of 1837"

Banking legislation and risky lending practices, combined with the westward expansion of the United States, fuels the “Panic of 1837.” This results in the failure of many banks, the suspension of specie payments (gold and silver coins), and plunged the national economy into a deep recession. Conservative banking practices, most significantly the gathering of gold and silver to back its paper currency, position Commercial Bank of Albany to be one of the first banks to resume specie payments, establishing its reputation for financial soundness and stability.

Source: "Courtesy of KeyBank Corporate Archives"

1849

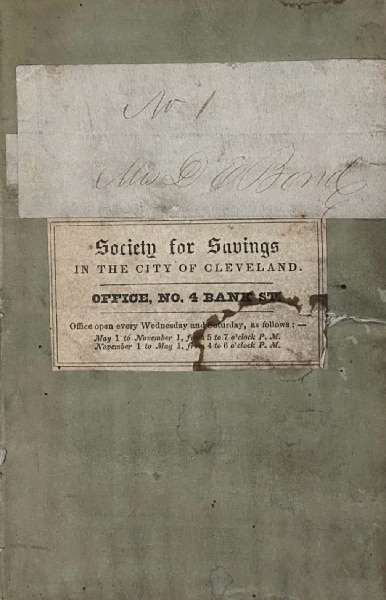

Society for Savings is established, with a woman as its first client

Society for Savings is established in 1849 in Cleveland, Ohio. As a mutual savings bank, the Society for Savings helps customers realize the benefits of managing their money prudently. Founders Samuel H. Mather and Charles J. Woolsen define the purpose for the Society for Savings: “to provide a secure investment to persons of either sex, who receive money in small sums and are desirous of saving it." True to its mission, the very first customer is a woman named Mrs. D.E. Bond, who deposits $25.

Source: "Courtesy of Western Reserve Historical Society"

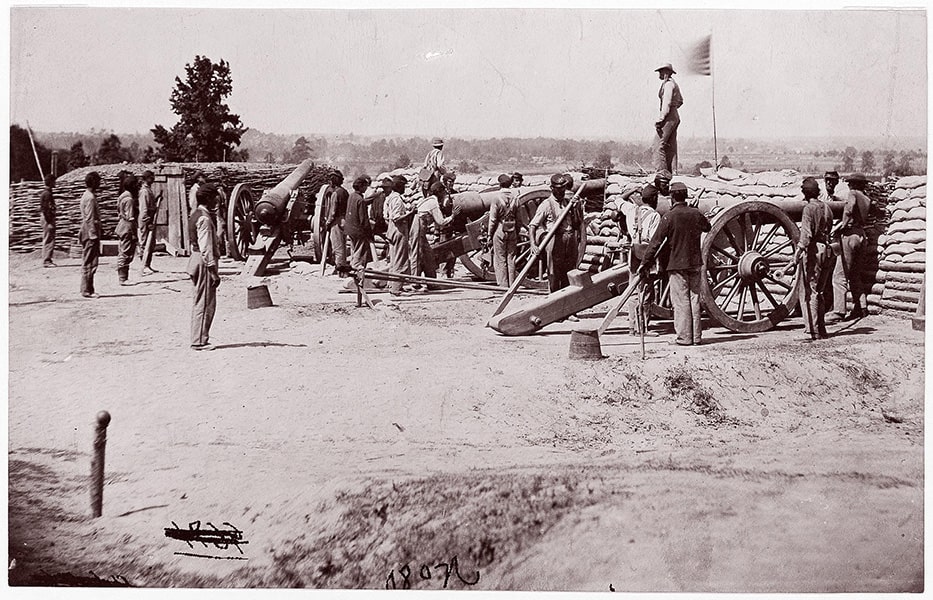

1861-1865

Financial support during the American Civil War

With the nation in the grip of the Civil War, the Commercial Bank of Albany aids the Union cause by providing $3.5 million to the State of New York to fund additional military recruits. The Civil War also prompts the National Banking Acts of 1863 and 1864, allowing the federal government to sell bonds to finance the war and establish a stable national currency.

Source: "Courtesy of The Met, Harris Brisbane Dick Fund, photo by Timothy H. O'Sullivan"

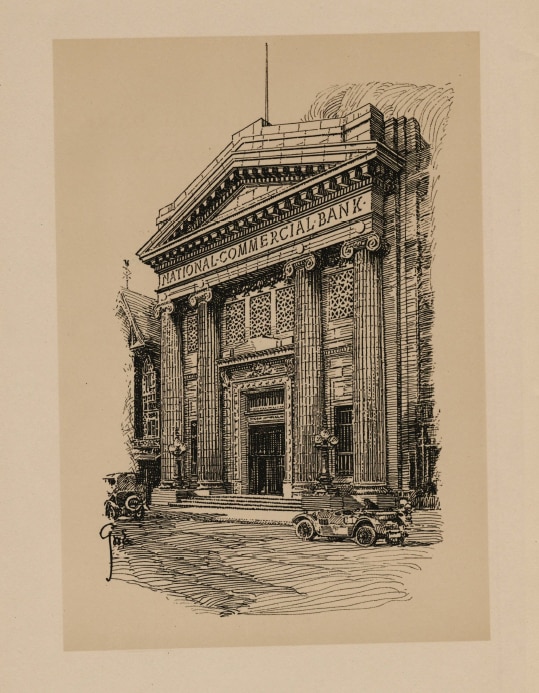

1865

Commercial Bank of Albany is chartered as a national bank

In 1865, the Commercial Bank of Albany reorganizes as a national bank under the National Banking Act of 1864. With its new charter, the bank becomes the National Commercial Bank of Albany.

Source: "Courtesy of New York State Library, Manuscripts and Special Collections"

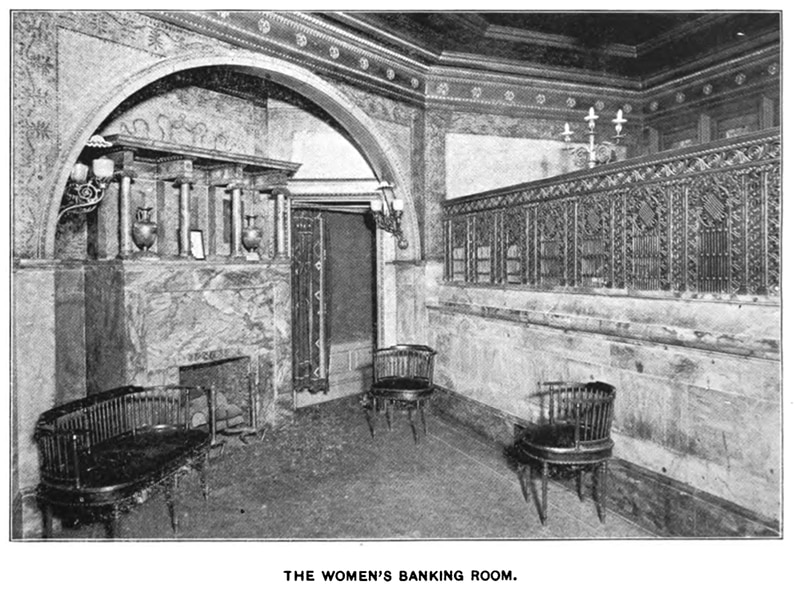

1889

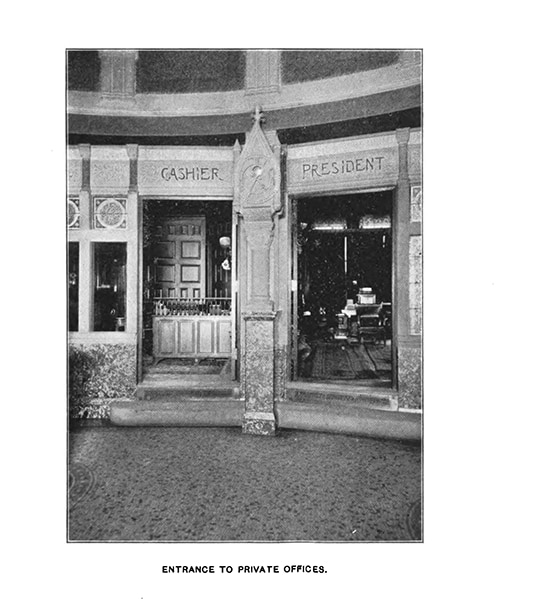

Banking opportunities for women

The National Commercial Bank of Albany creates a women’s banking room to deliver a comfortable banking experience for women in need of financial services.

Source: "Courtesy of KeyBank Corporate Archives"

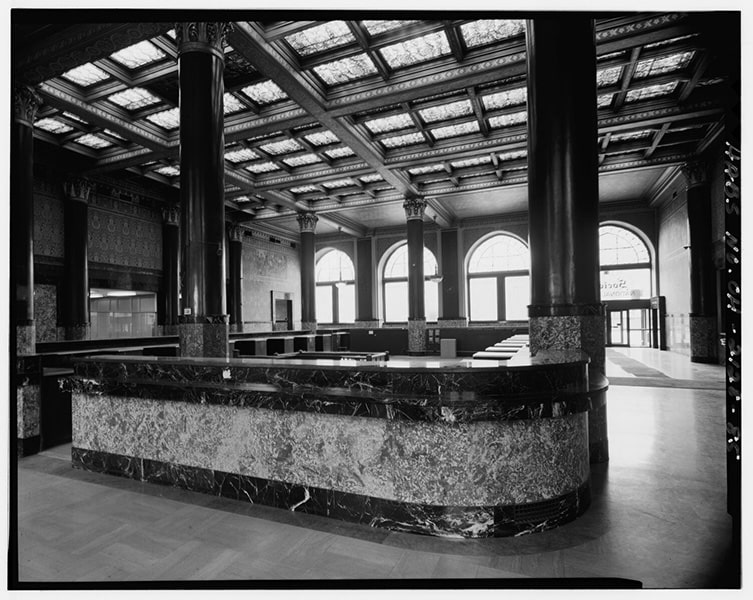

1890

Society for Savings constructs Cleveland’s first skyscraper

Society for Savings emerges as a thriving bank, becoming a model for other savings institutions across the country. Continuous growth prompts the construction of a new 10-story office and banking building at 127 Public Square, a first of its kind and designed to meet the needs of customers for years to come.

Source: "Courtesy of Cleveland Public Library Photograph Collection, photo by Detroit Publishing Company"

1910

Signaling stability with gold coins

Serious financial panics occur in 1893 and 1907, causing more and more people to become distrustful of banks and bankers. In 1910, nearly 5,000 people, mainly immigrants, wait in line for hours to withdraw money after rumors of financial crisis circulate through Cleveland. Society for Savings pays out more than $1 million in a day. Society for Savings reassures clients by placing gold coins behind the teller line, showing that their money was secure in being backed by gold.

Source: "Courtesy of Cleveland Public Library Photograph Collection"

1913

The Federal Reserve is established

As a response to serious financial panics that occurred into the early 20th century, the federal government sought to bring stability to American monetary actions and policy. Congress passes the Federal Reserve Act of 1913, which establishes the Federal Reserve Bank.

Source: "Courtesy of the Federal Reserve"

1913-1918

World War I

Both Society for Savings and National Commercial Bank of Albany create war chests and sell bonds to support the allied war effort. Society for Savings also expands its services to include a Home Economics Bureau, helping depositors buy war bonds using savings gained from better household budgeting.

Source: "Courtesy of Western Reserve Historical Society"

1920

A financial anchor in Public Square

With an ever-growing presence in Cleveland, 1 in 6 residents bank with Society for Savings by 1920. This strong relationship with Cleveland residents positions the bank for success and is a testament to the bank’s strength and stability through the many challenges of the early 20th century.

Source: "Courtesy of Western Reserve Historical Society"

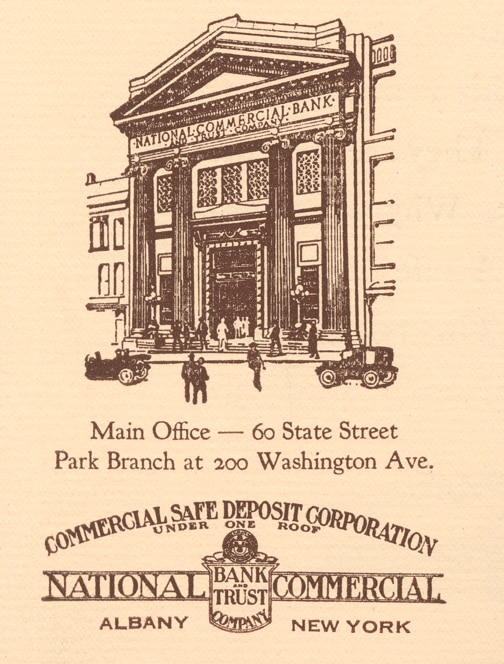

1920

First branch office

National Commercial Bank of Albany merges with Union Trust Company to become National Commercial Bank and Trust Company, with its first branch opening under this new name in Albany.

Source: "Courtesy of KeyBank Corporate Archives"

1925

National Commercial Bank and Trust Company celebrates 100 years

After opening its doors in 1825 with four employees and $3,500 as the Commercial Bank of Albany, the now National Commercial Bank and Trust Company celebrates its first 100 years of operation.

Source: "Courtesy of New York State Library. Manuscripts and Special Collections"

1925

Financial education in Cleveland public schools

In 1925, the Cleveland Board of Education asks Society for Savings to provide a savings program for children in public schools. In the coming decades, thousands of school children learn the value of saving money and managing finances.

Source: "Courtesy of Western Reserve Historical Society"

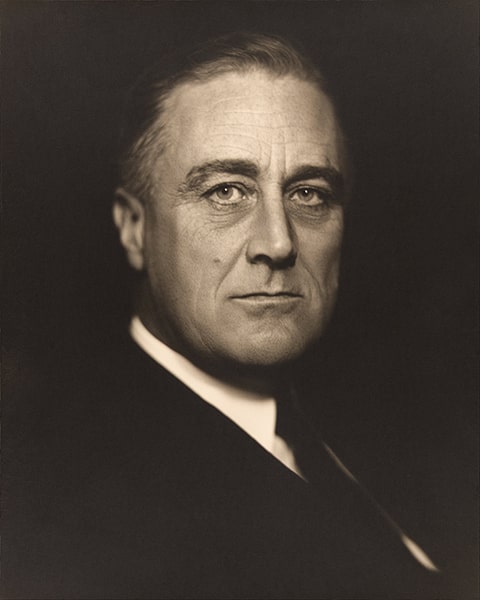

1929

The Great Depression

On October 29, 1929, the stock market crashes, plunging the global economy into the Great Depression. Within five years of the crash, almost half of the nation’s banks are either closed or acquired by stronger institutions. The challenges facing the entire national financial system culminate with the Bank Holiday of 1933, in which President Franklin D. Roosevelt, during a special session of Congress, closes all financial institutions over a four-day period to stabilize the nation’s banking system.

Source: "Courtesy of Getty Images"

1933

Persistence through the Great Depression

Both Society for Savings and National Commercial Bank and Trust Company, like most other financial institutions, experience incredible challenges and transformations throughout this decade.

Source: "Courtesy of Getty Images"

1933

Innovating to bolster the economy

Society for Savings pioneers intermediate term loans for businesses to bolster Cleveland's economy during the Great Depression.

Source: "Courtesy of Wikimedia Commons"

1939 – 1945

World War II

With the world embroiled in war, Society for Savings and National Commercial Bank and Trust Company are once again called upon to orchestrate the sale of war bonds to raise money for the allied effort, with National Commercial Bank and Trust in particular raising about $238 million in bond subscriptions. Additionally, National Commercial Bank and Trust is selected to test a ration auditing system, placing it in charge of accounting for food ration coupons. This experiment is so successful that the Ration Banking System is established nationally by January 1943.

Source: "Courtesy of National Archives"

1945

America’s neighborhood bank

To accommodate a new middle class eager to enjoy post-war prosperity, National Commercial Bank and Trust Company makes an important shift toward serving the consumer market, emerging as "America's neighborhood bank."

Source: "Courtesy of KeyBank Corporate Archives"

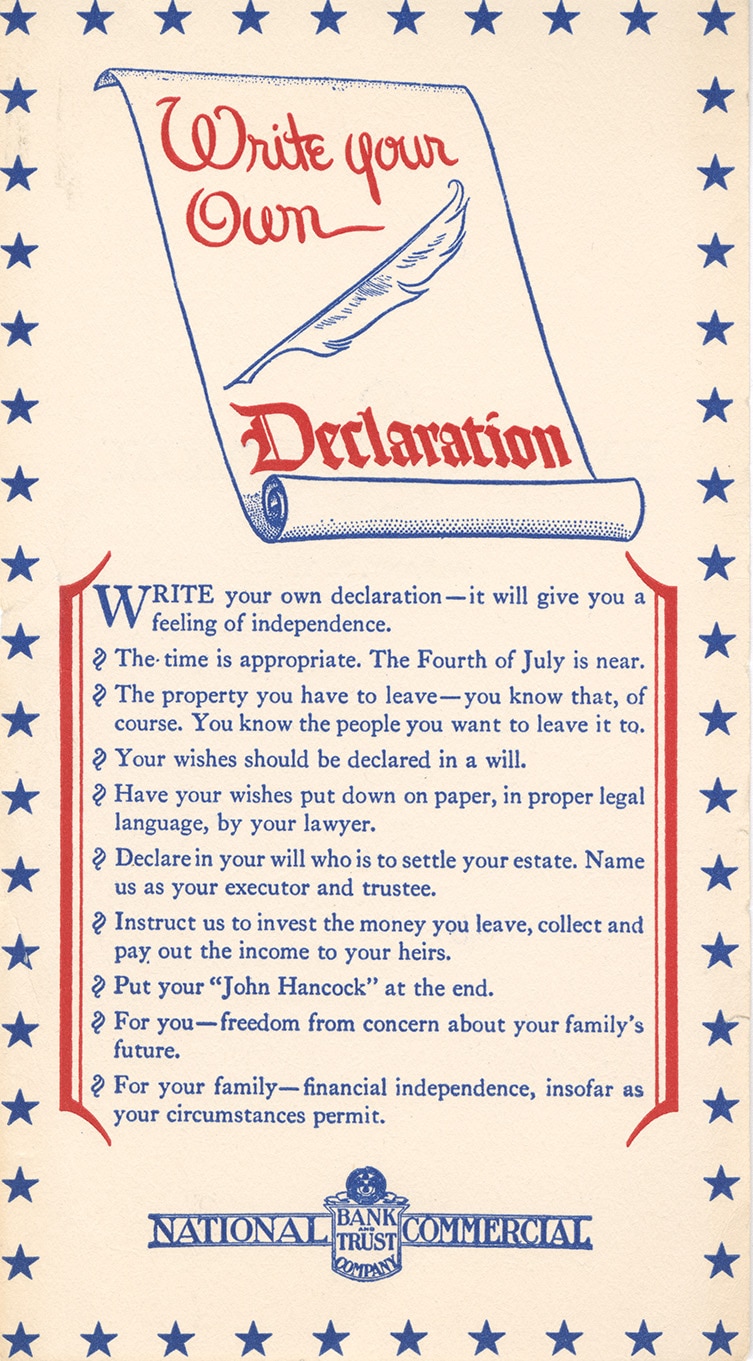

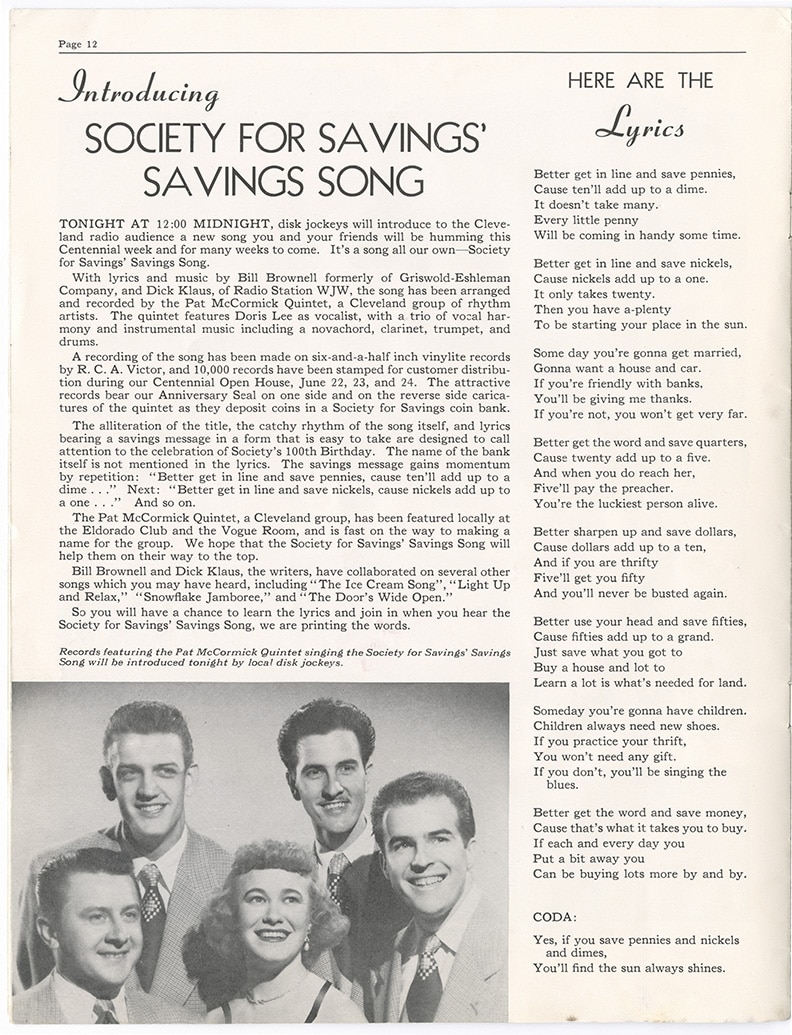

1949

Society for Savings celebrates 100 years

For its centennial anniversary, the Society for Savings marks the year with a series of celebrations, including the making of the “Savings Song.”

Source: "Courtesy of KeyBank Corporate Archives"

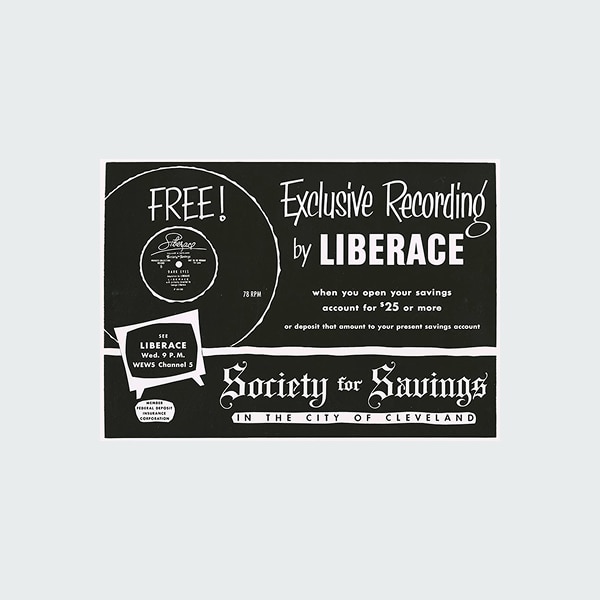

1954

Liberace exclusives for clients

Liberace records exclusive versions of “Dark Eyes” and “Brahms’ Lullaby” as part of a new promotion from Society for Savings. Customers would receive this record as a gift for depositing $25 or more in new or existing savings accounts. The response is tremendous, with more than $7 million in new deposits over a six-month period.

Source: "Courtesy of Western Reserve Historical Society"

1956

Society National Bank: navigating change

Society for Savings acquires The Bank of Ohio, thus establishing Society National Bank. For the next two years, Society for Savings and Society National Bank operate as separate entities.

Source: "Courtesy of Library of Congress Prints and Photographs Division"

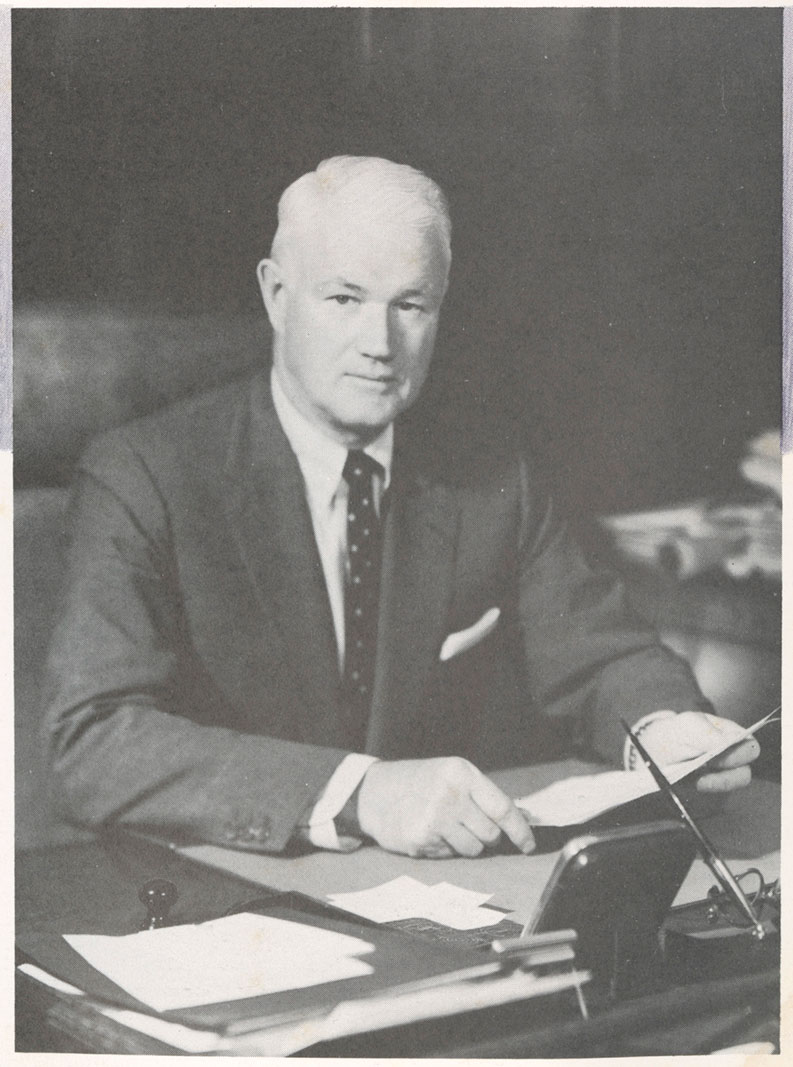

1958

Two become one

In 1958, Mervin France, Society National Bank's first modern president, sets the wheels in motion to merge the two companies. This merger of a mutual savings and national bank would be the first in American banking history and result in the formation of a new holding company: Society Corp.

In a letter to depositors, France says the following: "In uniting these two banks into Society National Bank of Cleveland, we combine the strength and heritage of the past with the promise of an even greater future."

Source: "Courtesy of KeyBank Corporate Archives"

1959

Taking the bank to the people

A mobile home, dubbed the "intermittent unit," is outfitted as a mobile bank office and sent to areas where branch offices had yet to be built.

Source: "Courtesy of KeyBank Corporate Archives"

1964

Civil Rights Act of 1964

A landmark piece of legislation for the United States, the Civil Rights Act of 1964 aimed to eliminate discrimination based on race, color, religion, sex, or national origin. The act sought to enforce constitutional rights and fundamentally reshaped the social landscape of America. It marked a significant milestone in the nation’s journey towards justice and equal treatment under the law. The act also laid the groundwork for future civil rights advancements.

Source: "Courtesy of KeyBank Corporate Archives"

1965

National Commercial Bank and Trust Company backs New York State employees

As the New York State Legislature fails to pass a budget in time to pay state employees, National Commercial Bank and Trust Company steps in to provide more than 50,000 workers with interest-free loans to cover their salaries.

Source: "Courtesy of KeyBank Corporate Archives"

1965

Society Corporation marks historic expansion

Society Corporation becomes the first bank holding company in northern Ohio with more than one affiliate upon the acquisition of Fremont Savings Bank.

Source: "Courtesy of KeyBank Corporate Archives"

1968

The Fair Housing Act is enacted

The Fair Housing Act was passed in 1968 to prohibit discrimination in housing based on race, color, religion, sex, national origin, disability, and family status, ensuring equal access to housing opportunities for all.

Source: "Courtesy of National Archives"

1969

The Society Foundation is formed

Later renamed the KeyBank Foundation in 2009, the Foundation is a nonprofit charitable organization funded by KeyCorp. The foundation’s mission is to focus on improving the lives of our neighbors, to increase access to high-quality education, and to help adults achieve the skills, education, and capabilities they need to succeed in employment opportunities.

Source: "Courtesy of KeyBank Corporate Archives"

1971

Society National Bank brings “instant banking” to its customers

Incorporating a comprehensively connected IBM electronic data processing system, a national first in banking, Society National Bank links tellers directly to a central computer and makes the service of “instant banking” available to clients.

Source: "Courtesy of Western Reserve Historical Society"

1971

Establishment of First Commercial Banks Inc.

National Commercial Bank and Trust Company merges with First Trust and Deposit Company, forming First Commercial Banks Inc.

Source: "Courtesy of KeyBank Corporate Archives"

1972

The mobile bank saves the day

As severe flooding impacts New York, First Commercial Banks Inc. deploys its mobile banking unit to assist those in need of financial services. During this effort, the mobile unit aids the workers of Corning Glass Works so they can receive paychecks after the local branch was forced to shutter.

Source: "Courtesy of The Library of Virginia"

1973

Victor J. Riley Jr. named President and CEO

Victor J. Riley is named President and CEO.

Source: "Courtesy of KeyBank Corporate Archives"

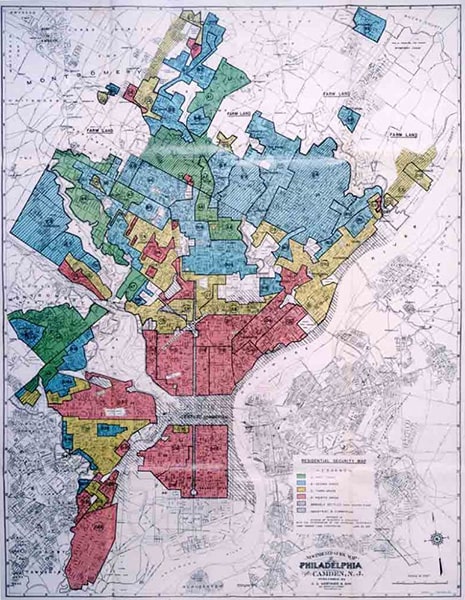

1977

Community Reinvestment Act is enacted

The Community Reinvestment Act (CRA) encourages banks to help meet the credit needs of their communities, including low- and moderate-income neighborhoods. KeyBank has consistently earned “Outstanding” CRA ratings since the act’s passage, most recently in 2024, highlighting our commitment to responsible and inclusive community investment.

Source: "Courtesy of National Archives"

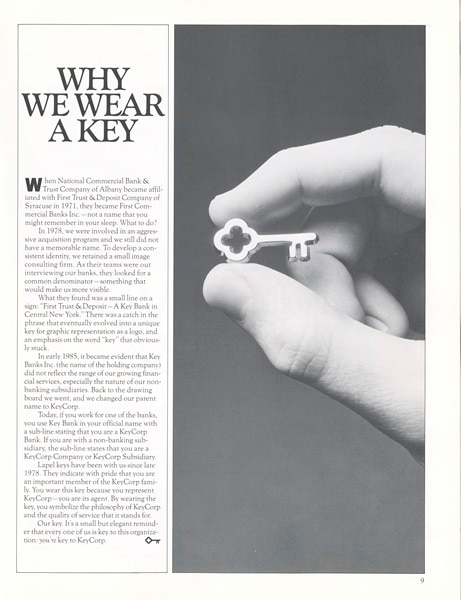

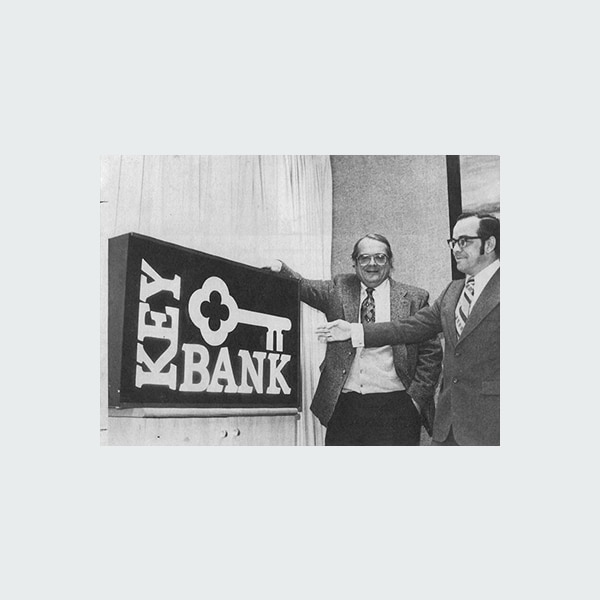

1978

A key becomes our symbol

First Commercial Banks Inc.’s leadership wants to make a cultural shift to represent that every single person involved with the company is integral to its success. To do so, employees begin wearing key pins on their lapels, a unifying symbol.

Source: "Courtesy of KeyBank Corporate Archives"

1979

First Commercial Banks Inc. becomes Key Banks Inc.

First Commercial Banks Inc. is renamed Key Banks Inc., with all subsidiary banks adopting the word “Key” into their name.

Source: "Courtesy of KeyBank Corporate Archives"

1983

Listing on the New York Stock Exchange

Key Banks Inc. is officially listed on the New York Stock Exchange with the ticker symbol “KEY.”

Source: "Courtesy of KeyBank Corporate Archives"

1984

Expansion beyond New York

Key Banks Inc. begins business in the state of Maine through its acquisition of the Depositors Corp. of Augusta, the largest banking group in the state.

Source: "Courtesy of KeyBank Corporate Archives"

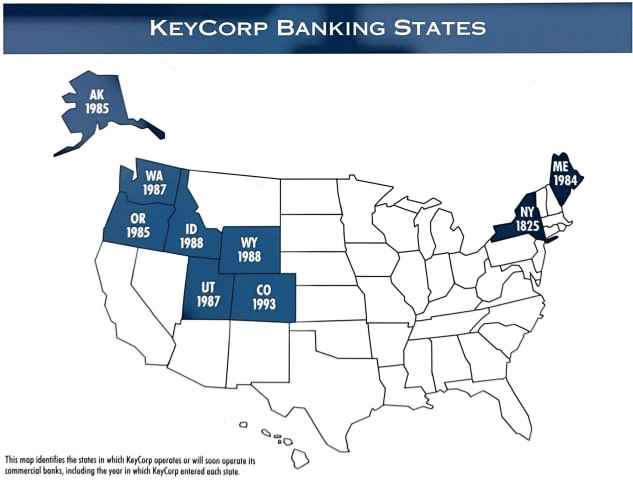

1985

KeyCorp is established

Key Banks Inc. becomes KeyCorp.

Source: "Courtesy of KeyBank Corporate Archives"

1990

Shaping Cleveland’s skyline

Society Corporation constructs the Society Center tower in Public Square. Standing at 57 stories tall, the structure becomes the tallest building not only in Cleveland, but in the entire state of Ohio.

Source: "Photograph by Stuart Spivach"

1991

Inaugural Neighbors Make The Difference® Day

KeyBank employees in Alaska decide to close branch offices for a portion of a day to focus on volunteer efforts within their community. This initiative quickly spreads throughout the company, and by 1993, KeyBank branches across the nation begin participating in this annual day of volunteerism, Neighbors Make The Difference® Day. This longstanding tradition still stands today.

Source: "Courtesy of KeyBank Corporate Archives"

1991

Additional growth for Society Corporation

Society Corporation merges with AmeriTrust, consolidating two of Cleveland’s largest banking institutions.

Source: "Courtesy of KeyBank Corporate Archives"

1994

Merging of equals

KeyCorp and Society Corporation merge, with the resulting company retaining the name KeyCorp. The decision is made to become fully headquartered in Cleveland.

Source: "Courtesy of KeyBank Corporate Archives"

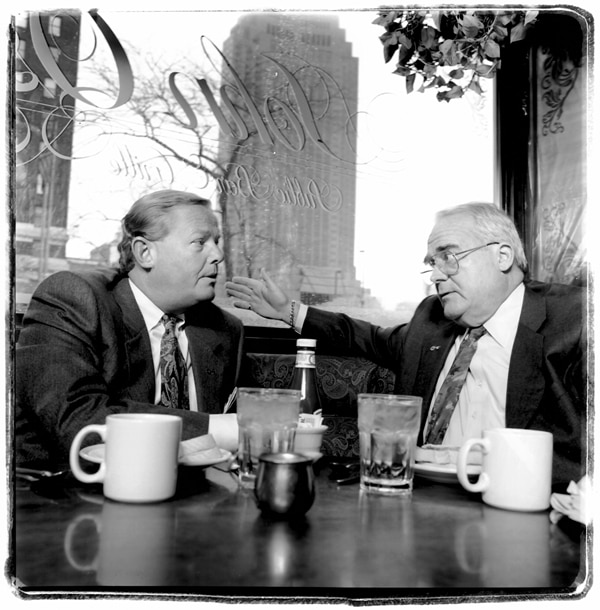

1994

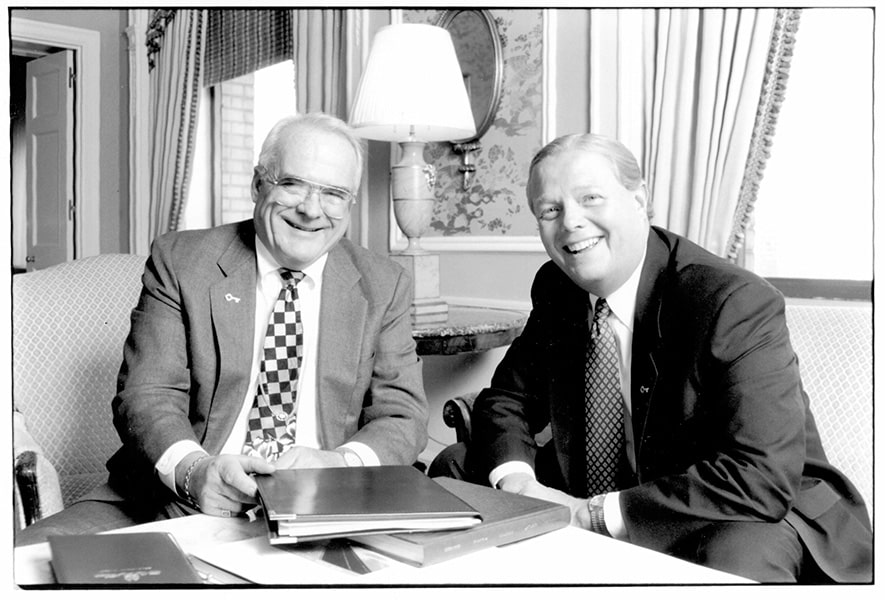

Dynamic leadership expands KeyBank's horizons

Victor J. Riley Jr. and Robert Gillespie’s executive leadership and personal relationship help turn a complex merger into reality, setting the foundation for KeyBank’s future.

Source: "Courtesy of KeyBank Corporate Archives"

1995

Robert “Bob” Gillespie named Chairman and CEO

Robert “Bob” Gillespie started his banking career as a teller at Cleveland Society for Savings in 1968. In 1995, he was elected chairman and CEO of KeyCorp. Under his leadership, KeyCorp evolved from a collection of local banks into a national, multi-line provider of integrated financial services. KeyBank became the nation's 14th largest financial services company through the 1992 acquisition of Ameritrust in Cleveland, Ohio, and the 1994 merger that combined KeyCorp of Albany, New York, with Society Corp of Cleveland, Ohio. Recognized for his extensive experience over a broad range of disciplines, Bob Gillespie’s leadership shaped and lifted his company, the financial services industry, and the Cleveland community.

Source: "Courtesy of KeyBank Corporate Archives"

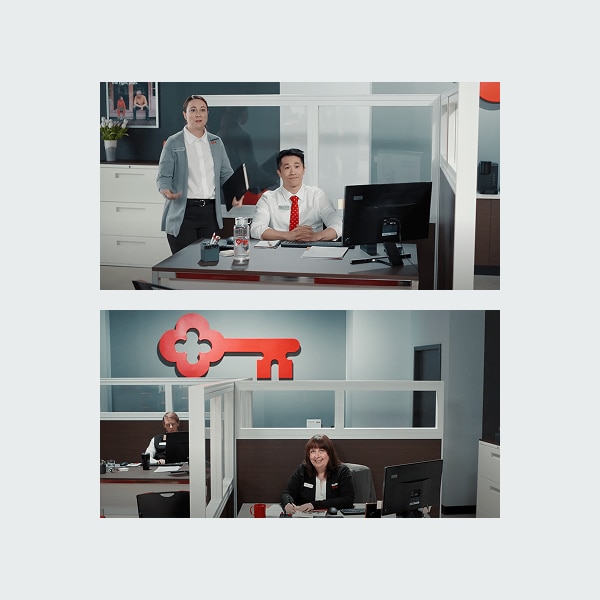

1996

New solutions that save you time

KeyBank launches a series of innovative banking solutions to save current and potential clients more time. To get the word out, KeyBank creates a memorable TV campaign to get Americans thinking about the importance of free time, a topic that continues to resonate.

Source: "Courtesy of KeyBank Corporate Archives"

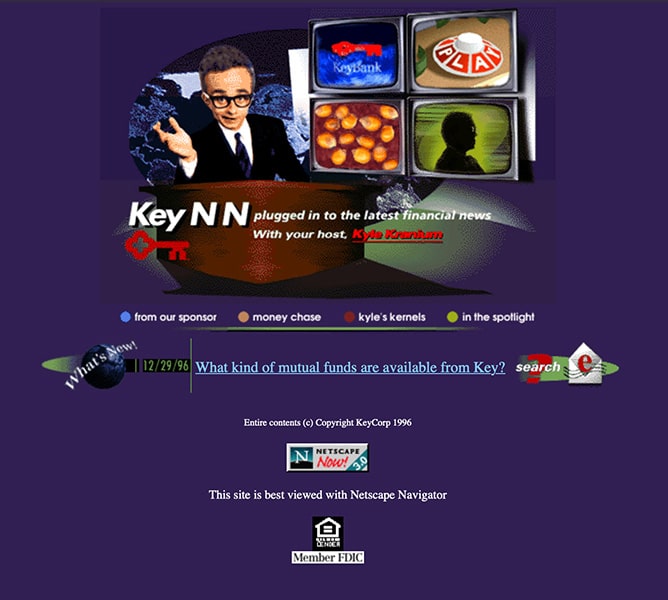

1996

KeyBank embraces the digital age

KeyBank launches KeyBank.com, providing its clients with banking resources that can be accessed from a personal computer.

Source: "Courtesy of KeyBank Corporate Archives"

1996

“Banking will never be the same again”

Continuing its tradition of building personal relationships with clients, KeyBank revitalizes many aspects of its customer-facing branding. The launch of customizable credit cards, a jukebox-shaped ATM at the Rock & Roll Hall of Fame, and the sponsorship of KeyArena, home of the Seattle Supersonics, are just a few innovative ways KeyBank reaches current and prospective customers.

Source: "Courtesy of KeyBank Corporate Archives"

2001

Henry L. Meyer III named Chairman and CEO

Henry Meyer began his four-decade career in banking when he joined Society National Bank as a teller, in Cleveland, Ohio, in 1972. In 2001, he became chairman and CEO. An exemplary leader, he led the bank during a period of significant growth and successfully navigated the company through the Great Recession of 2008. KeyBank’s longstanding culture of helping clients and communities thrive has its roots in Henry Meyer’s leadership and vision. He built a culture focused on inclusion and belonging inside and outside the company. In fact, he led the industry by establishing best practices for supplier diversity. A passionate and tireless advocate for the region, our neighbors, and our neighborhoods, Henry Meyer served on numerous non-profit boards and championed countless civic endeavors.

Source: "Courtesy of KeyBank Corporate Archives"

2007

In on iPods early

KeyBank launches an iPod Nano promotion for those opening a new checking account. As these devices were in high demand and relatively new to the market, this campaign emphasizes KeyBank’s reputation as a company that’s ahead of the curve.

Source: "Courtesy of Wikimedia Commons, photograph by Eduardo Lopez"

2007

The Great Recession

Beginning in 2007 and having significant impacts across the nation for many years to come, the economic crisis of the late 2000s would see a major disruption to the American financial system.

Source: "Courtesy of Library of Congress, Prints and Photographs Collections"

2011

Women lead the way

Beth E. Mooney becomes the first woman to serve as a Chair and Chief Executive Officer of a top 20 bank as she takes the reins at KeyCorp. Under her steady leadership, Beth guided KeyCorp through recovery from the 2008 financial crisis and led KeyCorp's acquisition of First Niagara Financial Group, the largest industry merger since the financial crisis. She transformed KeyBank into a top tier regional bank, leaving the bank well-positioned for continued growth. Beth also makes a notable impact through her support of community initiatives such as "Say Yes to Education," strengthening the bank’s work on building inclusive workplace environments.

Source: "Courtesy of KeyBank Corporate Archives"

2012

Continued commitment to Native American communities

KeyBank was one of the first financial institutions in the United States to create teams exclusively focused on serving Native American communities. In 2012, KeyBank Foundation partnered with First Nations Oweesta Corporation to launch a four-year financial literacy program. The program’s unique approach trains the trainers, allowing Oweesta professionals to continue to teach people in their communities how to manage their money, save for their financial goals, take advantage of financial resources, and avoid predatory lenders.

Source: "Courtesy of Getty Images"

2015

Continued expansion

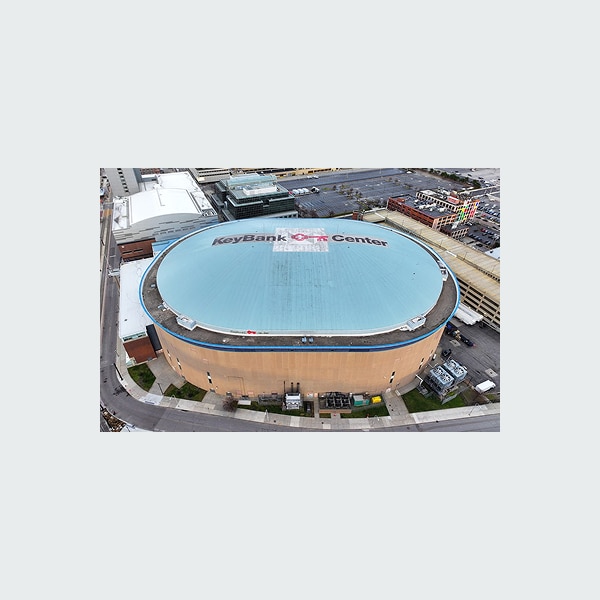

KeyBank acquires First Niagara Bank of Buffalo, New York.

Source: "Courtesy of KeyBank Corporate Archives"

2016

National Community Benefits Plan

In 2016, KeyBank announced our National Community Benefits Plan, a groundbreaking commitment that will lend and invest $16.5 billion in our communities beginning in 2017. This five-year plan will center on mortgage and consumer loans, small business lending, community development lending and investment, and philanthropy.

Source: "Courtesy of KeyBank Corporate Archives"

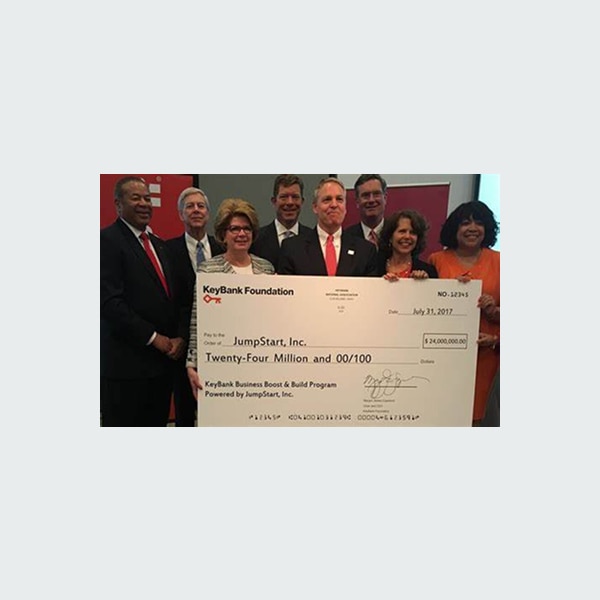

2017

Powering small business success

Through a historic $24 million grant to JumpStart Inc., The KeyBank Foundation powers the Business Boost & Build Program, focused on fostering small business growth and enabling business ownership opportunities.

Source: "Courtesy of KeyBank Corporate Archives"

2018

Commitment to the arts

KeyBank Foundation makes two, record-setting $10 million commitments to the Rock & Roll Hall of Fame and Playhouse Square in Cleveland. The contributions help both organizations deliver on their missions designed to improve access to arts and culture and importantly, fund programs that ensure free access for Clevelanders and students.

Source: "Courtesy of KeyBank Corporate Archives"

2019

Saying yes to education

The KeyBank Foundation contributes $10 million to the Say Yes Cleveland scholarship fund, supporting hundreds of Cleveland Metropolitan School District graduates achieve their higher education goals.

Source: "Courtesy of KeyBank Corporate Archives"

2020

Chris Gorman takes the lead during an unprecedented time

Chris Gorman assumes the role of KeyCorp CEO in 2020. Through his leadership, KeyBank navigates the unprecedented challenges of the COVID-19 pandemic by prioritizing teammate safety and client service while ensuring continued support of the communities KeyBank serves. He champions KeyBank’s participation in the Paycheck Protection Program, ensuring that thousands of small businesses secure critical financial relief, remain open, and can pay their employees. Gorman charts a course for KeyBank’s future that honors our enduring commitment to clients and communities while ensuring investment in contemporary capabilities and experiences. As a testament to his leadership and stewardship, KeyBank is well positioned for sound, profitable growth, today and across the decades to come.

Source: "Courtesy of KeyBank Corporate Archives"

2021

Resilience and safety during global pandemic

As the COVID-19 pandemic grips the world, KeyBank is there when our clients, colleagues, and communities need us most. KeyBank becomes one of the largest funders of Paycheck Protection Program loans, helping businesses stay open during the pandemic. Banking norms are eased to allow employees to visit homes and offices of clients who aren’t comfortable with coming into branches. The “Heart of Key Program” is established and distributes special pins to the 2,000+ frontline employees who continue to work at branches throughout the pandemic.

Source: "Courtesy of KeyBank Corporate Archives, photo by Quintin Soloviev"

2021

Expanding commitment to the community

In 2021, KeyBank announces the extension and expansion of community commitments from $16.5 billion to $40 billion into communities across its footprint. The commitments go on to positively impact affordable housing, home lending, and philanthropy in low-to-moderate income communities as well as renewable energy financing and specific commitments to advance economic, social, equity, inclusion, and belonging.

Source: "Courtesy of KeyBank Corporate Archives"

2021

Removing barriers to healthcare

Through a $1.5 million grant to The MetroHealth System, The KeyBank Foundation works to improve access to healthcare resources in Cleveland. With this funding, MetroHealth's Institute for H.O.P.E.TM is aided in providing optimal individual and community health services.

Source: "Courtesy of MetroHealth"

2021

Helping to promote small business growth in underserved communities

KeyBank Foundation awards a grant to the Africatown Community Land Trust to support the expansion of a small business development program designed to help black entrepreneurs incubate and grow their businesses.

Source: "Courtesy of KeyBank Corporate Archives"

2021

Aiding economic stability in Native American communities after Covid

KeyBank Foundation provides a $300,000 grant to the National Center for American Indian Enterprise Development to help support tribal businesses negatively impacted by the Covid-19 pandemic.

Source: "Courtesy of Adobe Stock"

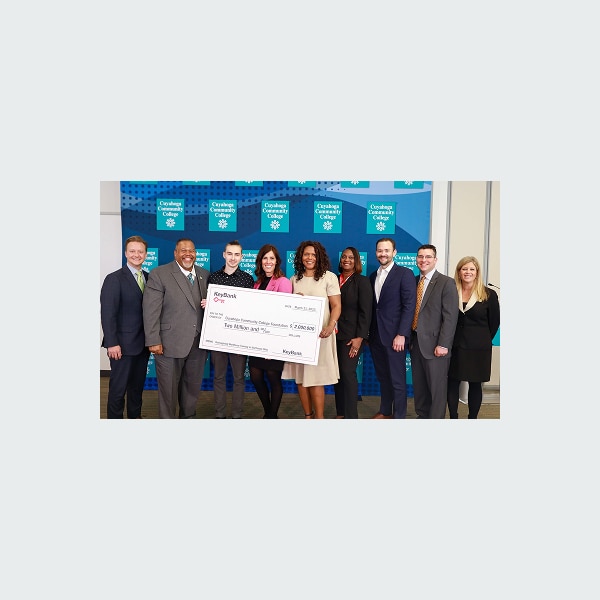

2022

Expanding accessibility and innovation in workforce training

KeyBank Foundation invests $2 million in Cuyahoga Community College (Tri-C) to help expand Tri-C’s Workforce, Community and Economic Development division. The division aims to enroll individuals who are under-employed and under-represented in key industries, offering more than 60 training programs in high-demand fields that offer family-sustaining salaries.

Source: "Courtesy of KeyBank Corporate Archives"

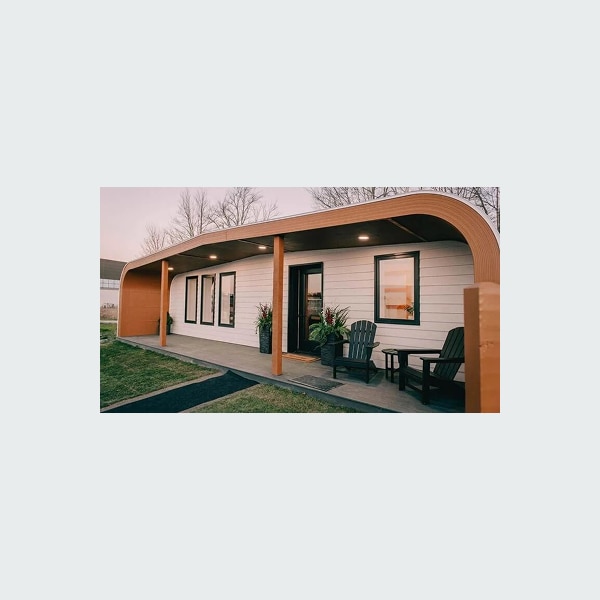

2022

Investing in technology to help bring new affordable housing to Maine

KeyBank Foundation helps make possible an innovative and environmentally conscious 3D-printed housing solution by partnering with Penquis CAP, University of Maine Advanced Structures and Composites, and MaineHousing. The nine-home pilot program is the first step to creating a new manufacturing process, new jobs, and new affordable housing in the community.

Source: "Courtesy of KeyBank Corporate Archives"

2023

Launch of groundbreaking relationship with Operation HOPE

KeyBank works with Operation HOPE, a national non-profit dedicated to financial empowerment in underserved communities, to launch a program delivering financial education programming and coaching free of charge, including homebuyer education, to underserved communities in the Buffalo area.

Source: "Courtesy of KeyBank Corporate Archives"

2024

Meeting you in the moment

KeyBank continually finds innovative ways to reach its customers throughout its history, even coming to them when the need arises. From its earliest mobile branches, KeyBank has always been committed to “Meeting you in the moment,” helping to foster meaningful relationships with its clients, wherever they may be. A campaign based on this commitment brings the idea of going mobile to a whole new level. Key creates six mobile Automated Thank You Machines that dispense treats like cookies, tacos, and toys to surprise and delight the communities it serves and make memorable connections.

Source: "Courtesy of KeyBank Corporate Archives"

2025

Key celebrates 200 years

As America approaches its 250th anniversary, KeyBank is proud to celebrate the two centuries of history that we’ve been a part of. Our teammates – 17,000 strong from Maine to Alaska – are more dedicated than ever to deliver on our purpose: to help our clients and communities thrive.

Our steadfast dedication to transforming lives and livelihoods, delivering transformative philanthropy in the communities we are proud to call home, and supporting our colleagues personally and professionally, will be the driving forces that propel us through the next 200 years.

Source: "Courtesy of KeyBank Corporate Archives"