Survey data shows middle market leaders are doubling down on tech, talent, and capital

Insights from KeyBank’s latest Middle Market Sentiment survey of over 700 business leaders highlight middle market companies’ strong ability to adapt and innovate. While inflation, labor, and other operational concerns remain, leaders report easing pressures in these key areas. As organizations strategically balance proactive investments with cautious risk management, several significant trends emerge.

Commercial lending has become increasingly important, underscoring the value businesses place on stable, reliable financial partnerships. Additionally, companies are prioritizing cybersecurity, recognizing the need to remain vigilant against evolving threats. Understanding these dynamics is critical as businesses prepare for the year ahead. Our survey data explores deeper insights into how middle market companies are these challenges and positioning themselves for future success.

Companies are growing their revenues and workforce

There’s good news to share about growth in the middle market: most of the leaders KeyBank surveyed reported year-over-year growth in revenue. Those with a positive company outlook reported higher growth than those with lower outlooks, but surprisingly, those with “fair” or “poor” company outlooks also reported high growth.

Compared to other segments, businesses that are based in the Midwest, operate within the technology industry, and have $250-$500 million in total annual revenues all reported the highest percentages of annual growth between 2022 and 2024. Once again, those with a positive company outlook within these segments tended to outperform their peers.

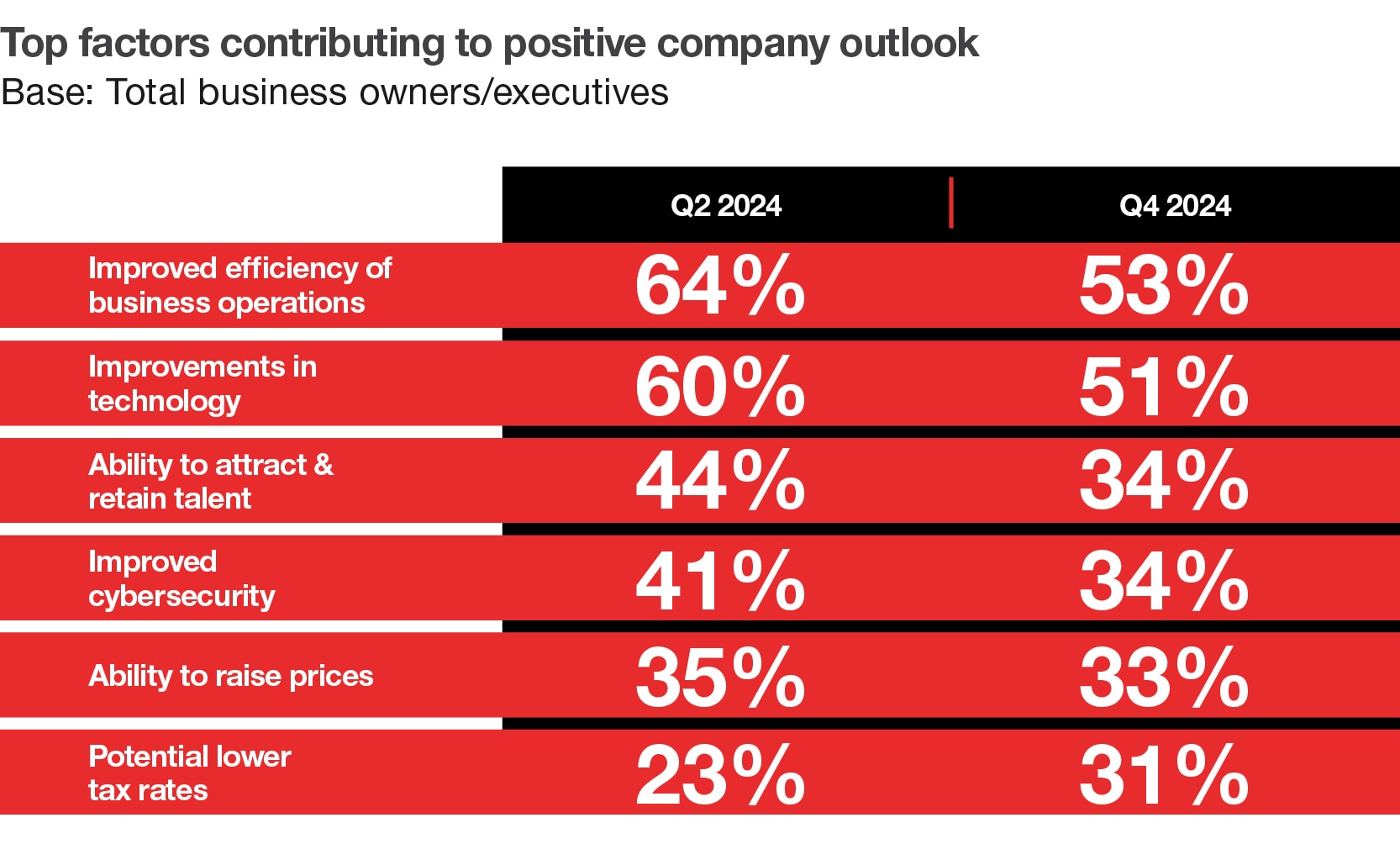

Among business leaders with a positive company outlook, the top three contributing factors (although down from the second quarter of 2024) remained improved efficiency of business operations, improvements in technology, and the ability to attract and retain talent. Additionally, the number of respondents citing potential for lower tax rates (31%) and the new political landscape (29%) increased significantly.

GRAPH 7 – Top factors contributing to positive company outlook

Base: Total business owners/executives

Improved efficiency of business operations

Q2 2024 64%

Q4 2024 53%

Improvement in technology

Q2 2024 60%

Q4 2024 51%

Ability to attract & retain talent

Q2 2024 44%

Q4 2024 34%

Improved cybersecurity

Q2 2024 41%

Q4 2024 34%

Ability to raise prices

Q2 2024 35%

Q4 2024 33%

Potential lower tax rates

Q2 2024 23%

Q4 2024 31%

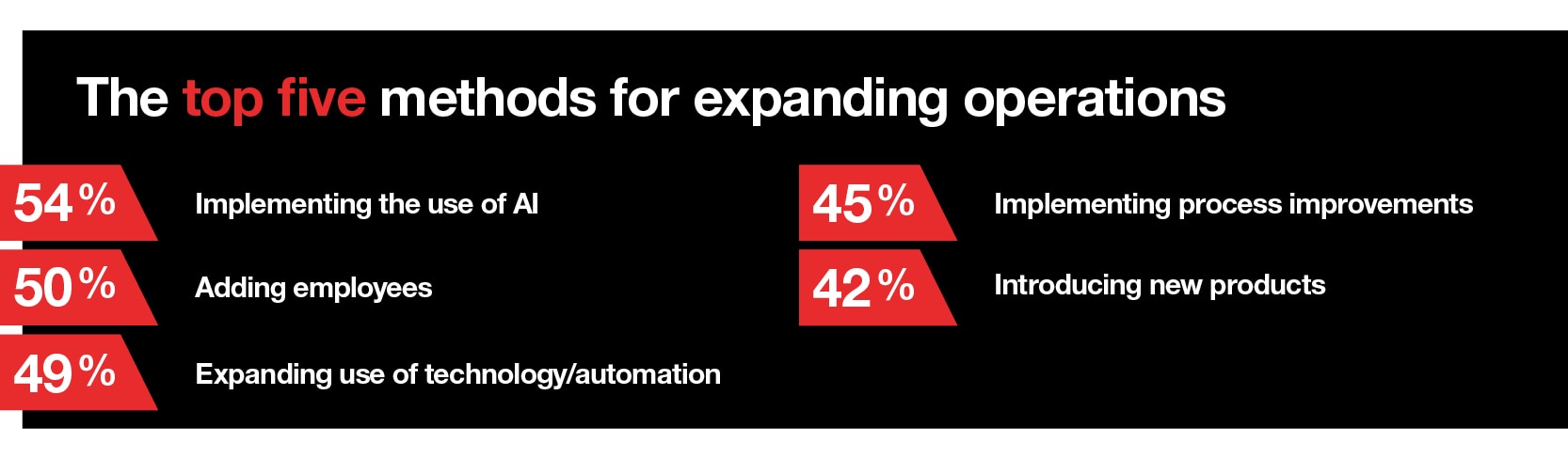

As middle market businesses grow, they’re embracing AI, technology, and research and development (R&D) — and hiring more workers to manage the expansion. Between 2022 and 2024, the share of middle market businesses employing 2,000 or more people increased from 16% to 20%, and the median number of full-time employees grew from 400 to 500. There was also a significant increase in the share of companies planning to expand the scope of their businesses through R&D.

GRAPH 8 – The top five methods for expanding operations

54% Implementing the use of AI

50% Adding employees

49% Expanding use of technology/automation

45% Implementing process improvements

42% Introducing new products

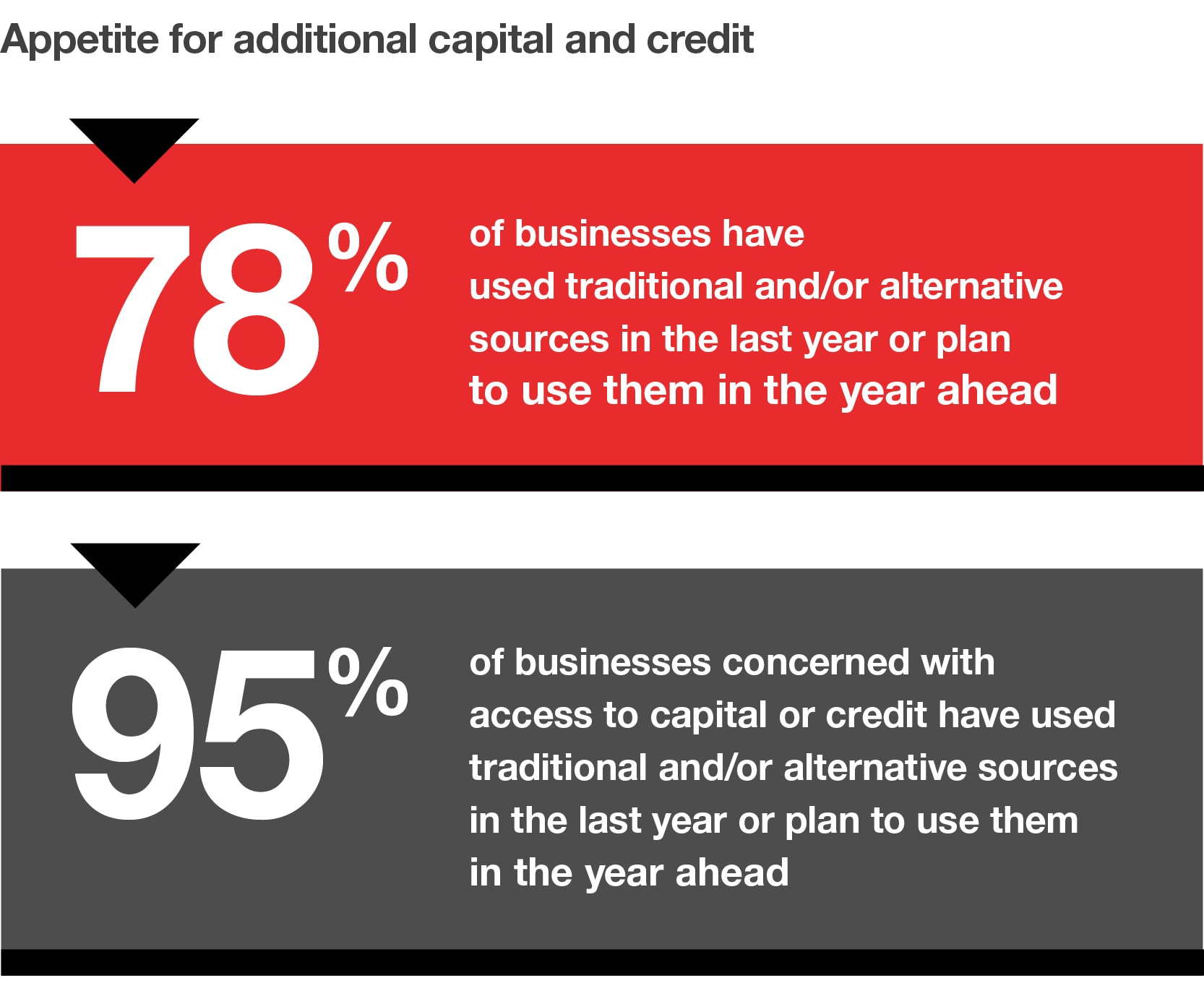

Commercial lending ranks highest among potential sources of capital/credit

More than three-quarters of surveyed middle market business leaders said they used traditional and/or alternative sources of capital and/or credit in 2024 or planned to use them in 2025. Among those concerned with access to capital or credit, that number increased to 95%.

GRAPH 11 – Appetite for additional capital and credit

78% of businesses have used traditional and/or alternative sources in the last year or plan to use them in the year ahead

95% of businesses concerned with access to capital or credit have used traditional an/or alternative sources in the last year or plan to use them in the year ahead

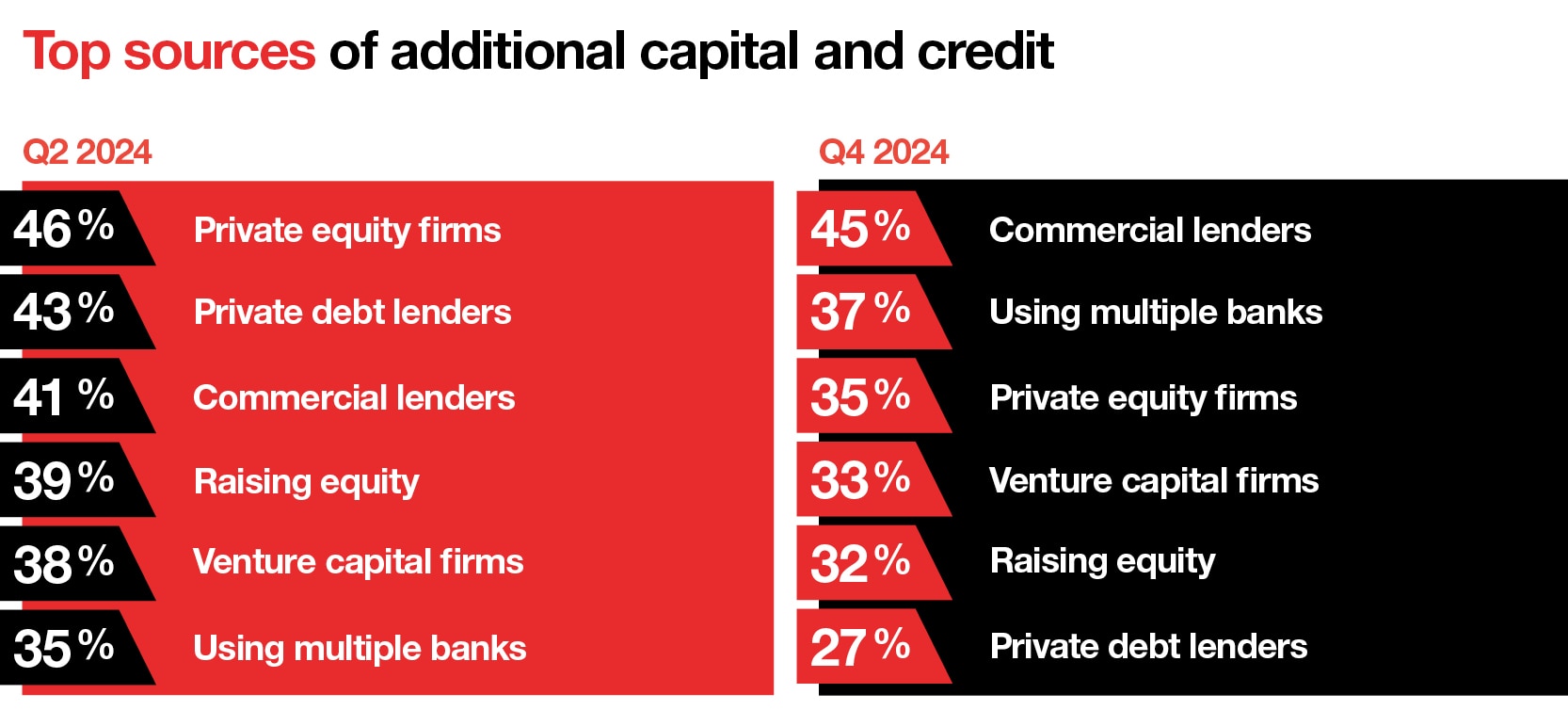

At the end of 2024, commercial lenders were the top source for middle market businesses seeking capital and credit. This represents a shift from six months prior, when private equity and private debt were the top two sources and commercial lending ranked third.

While private equity and private debt deals often attract attention in the marketplace, many executives and business owners prioritize the stability of working with an established commercial lender — particularly as these lenders’ appetites for deals is trending upward.

GRAPH 12 – Top sources of additional capital and credit

Q2 2024

46% Private equity firms

43% Private debt lenders

41% Commercial lenders

39% Raising equity

38% Venture capital firms

35% Using multiple banks

Q4 2024

45% Commercial lenders

37% Using multiple banks

35% Private equity firms

33% Venture capital firms

32% Raising equity

27% Private debt lenders

First and foremost, the increased appetite for commercial lending is about cost of capital. Bank debt is cheaper, easier, and not as restrictive. Even though private equity is rapidly penetrating the lower middle market, there’s a portion of that segment that isn’t ready to give up their own equity yet.

Michael P. McMahon

Buffalo Market President

Commercial Banking Executive – Upstate NY

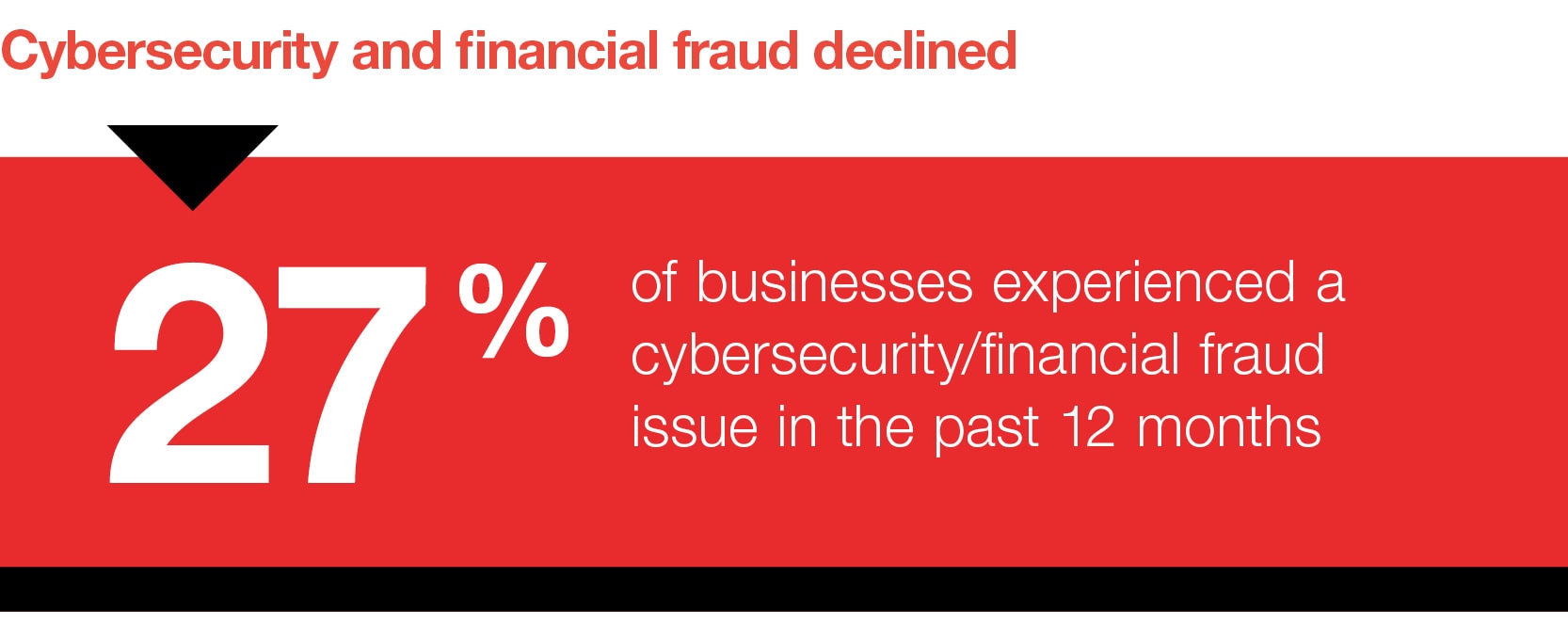

Fraud and cybersecurity incidents trend downward

Fraud protection and education efforts by middle market businesses and their banking partners seem to be paying off.

The latest survey revealed a decline in both the share of business leaders and executives who said that cybersecurity concerns were currently having a negative impact on their businesses and the share who had experienced a cybersecurity or financial fraud issue within the past 12 months. However, with AI-based fraud tactics still in their infancy, businesses and banks must remain vigilant as new threats emerge.

GRAPH 13 – Cybersecurity and financial fraud declined

27% of businesses experienced a cybersecurity/financial fraud issue in the past 12 month

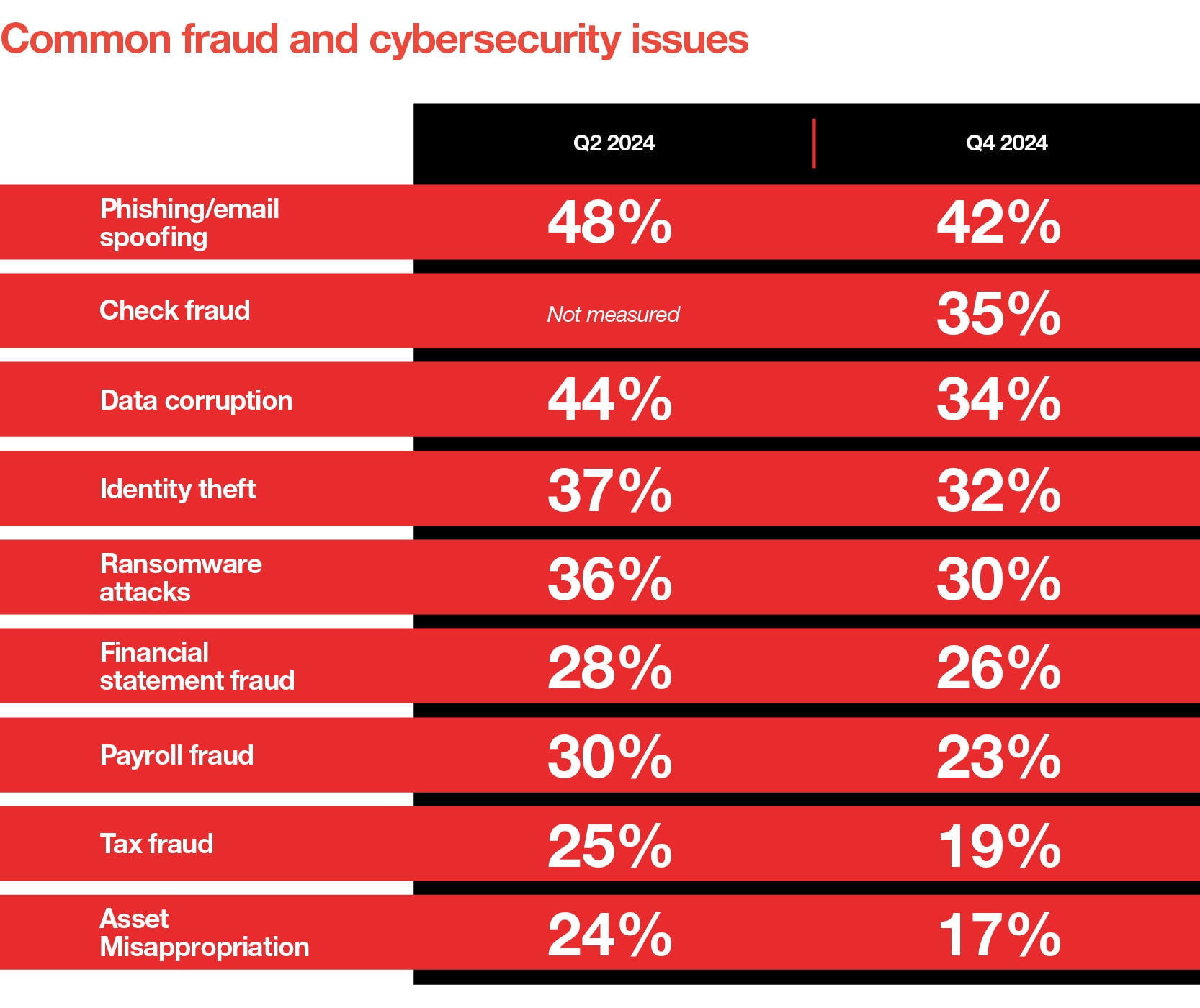

GRAPH 14 – Common fraud and cybersecurity issues

Phishing/email spoofing

Q2 2024 48%

Q4 2024 42%

Check fraud

Q2 2024 Not measured

Q4 2024 35%

Data corruption

Q2 2024 44%

Q4 2024 34%

Identity theft

Q2 2024 37%

Q4 2024 32%

Ransomware attacks

Q2 2024 36%

Q4 2024 30%

Financial statement fraud

Q2 2024 28%

Q4 2024 26%

Payroll fraud

Q2 2024 30%

Q4 2024 23%

Tax fraud

Q2 2024 25%

Q4 2024 19%

Asset Misappropriation

Q2 2024 24%

Q4 2024 17%

Middle market leaders also need to be aware of “old” threats. Despite the availability of faster, more secure, and more cost-effective payment methods, 93% of business leaders reported issuing payments by paper check within the past year.

GRAPH 15 – 93% of middle market companies have made a payment with a physical check in the last year

Businesses that continue to rely on checks, including those that use them infrequently, are vulnerable to the perpetual threat of check fraud — which affected more than one-third of respondents who reported a cybersecurity or fraud issue in 2024.

Protecting a business against fraud is an ongoing challenge — and each new threat represents a moving target. Business leaders need to have a focused, open dialogue about fraud and cybersecurity with their bank representatives at least once a year to align on behaviors and solutions to mitigate fraud.

Matt Swope

Senior Product Leader

KeyBank Payments

Conclusion

As illustrated by the survey findings, middle market businesses continue to demonstrate resilience and strategic foresight. Emphasizing investments in technology, cybersecurity, and talent development remains essential for successfully the evolving landscape.

Equally important will be maintaining a sharp focus on operational efficiencies and proactive risk management practices. Companies that effectively balance these priorities are well-positioned to capitalize on emerging opportunities and achieve sustained growth.

Ultimately, trusted partnerships, especially with reliable commercial lenders, will play a pivotal role in supporting middle market companies as they confidently move forward through 2025.

With a focus on understanding the unique dynamics of middle market businesses, KeyBank can help you navigate challenges and seize new opportunities with confidence. Our relationship-driven approach means that as the economy shifts, we stay focused on your success — not just for today, but for years to come.

To see how we can help you reach your goals, contact us or visit key.com/commercial.