Unlike large corporations that can wait out uncertainty, middle market firms must plan with incomplete information. That’s why many are treating the OBBBA as a tailwind, not a guarantee. The most confident leaders are setting trigger points. If demand or rates hold steady, they’ll move. If not, they’ll preserve liquidity and wait for the next signal.

Key’s takeaway: The middle market expects moderate growth in 2026, led by investment, not hiring. The firms that stay flexible with capital plans and financing will capture the most benefits.

3. Positive business impact outweighs concerns, but divides remain

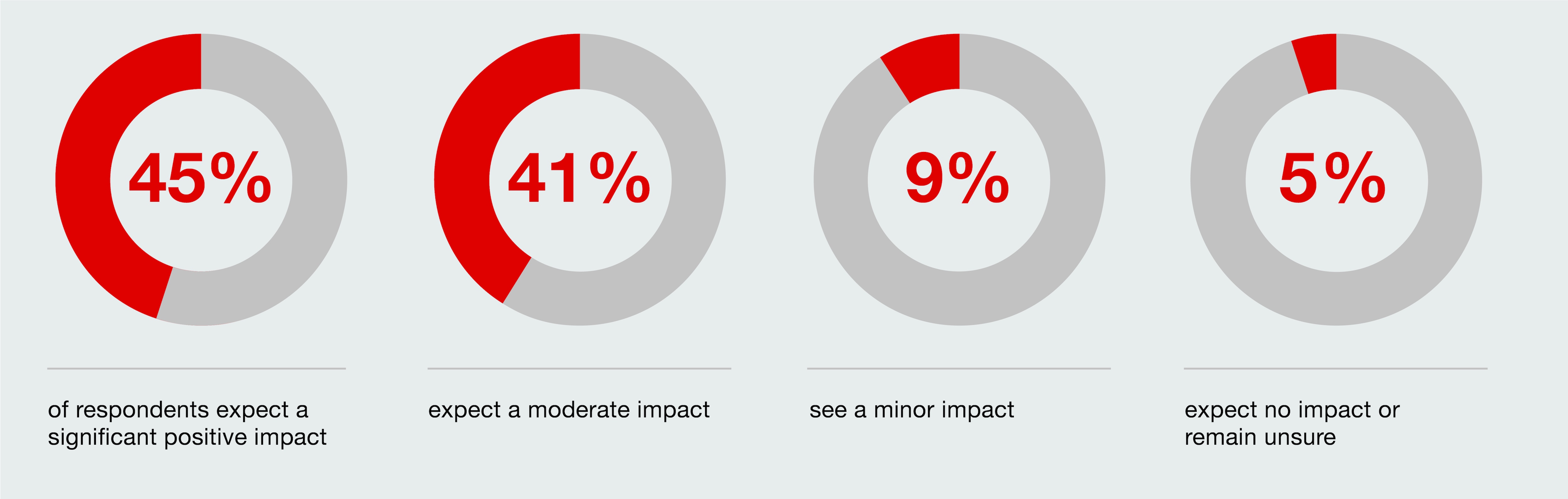

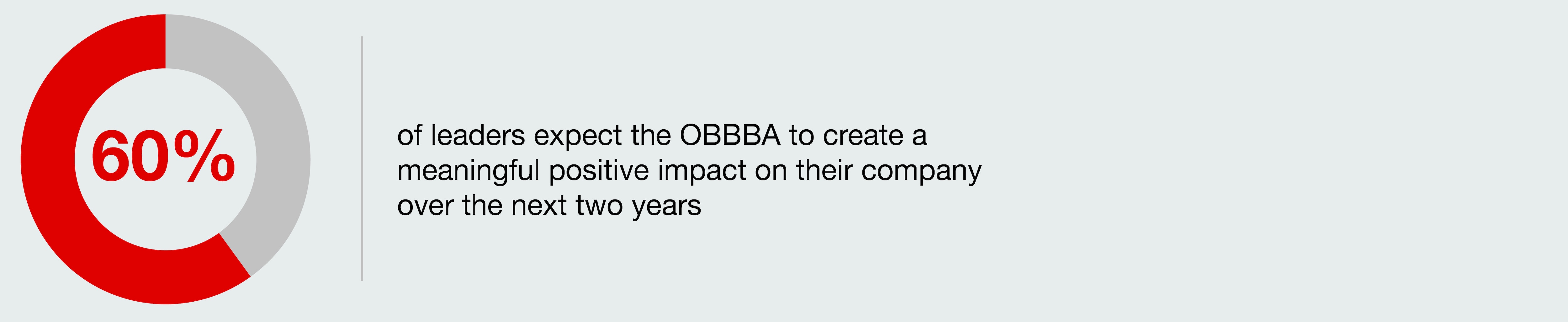

Turning to the impact on individual businesses, results are encouraging: six in 10 leaders (60%) expect the OBBBA to create a meaningful positive impact on their company over the next two years.

That optimism, however, coexists with a note of caution. Three in 10 (30%) anticipate a meaningful negative impact, while 10% expect little or no change.

This isn’t simply optimism versus pessimism. It’s readiness versus restraint.

Those expecting upside tend to have healthier balance sheets, access to credit, and stronger operating cash flow. They can act fast on equipment purchases, technology upgrades, and R&D.

Those anticipating downside may be facing refinancing pressures, thin margins, or limited bandwidth to execute new projects. Their challenge isn’t the bill itself, but the cost of participation.

What’s notable is that the split in expectations mirrors the split in familiarity. It could be the 60% who feel “very familiar” with the OBBBA’s provisions are the same 60% projecting positive outcomes. Knowledge, perhaps, is a proxy for readiness.

Key’s takeaway: Understanding the policy is half the advantage. Firms that translate awareness into specific financial playbooks (timing purchases, managing debt, and structuring depreciation) could outperform peers who wait for clarity.

4. Depreciation and R&D provisions expected to have outsized impact

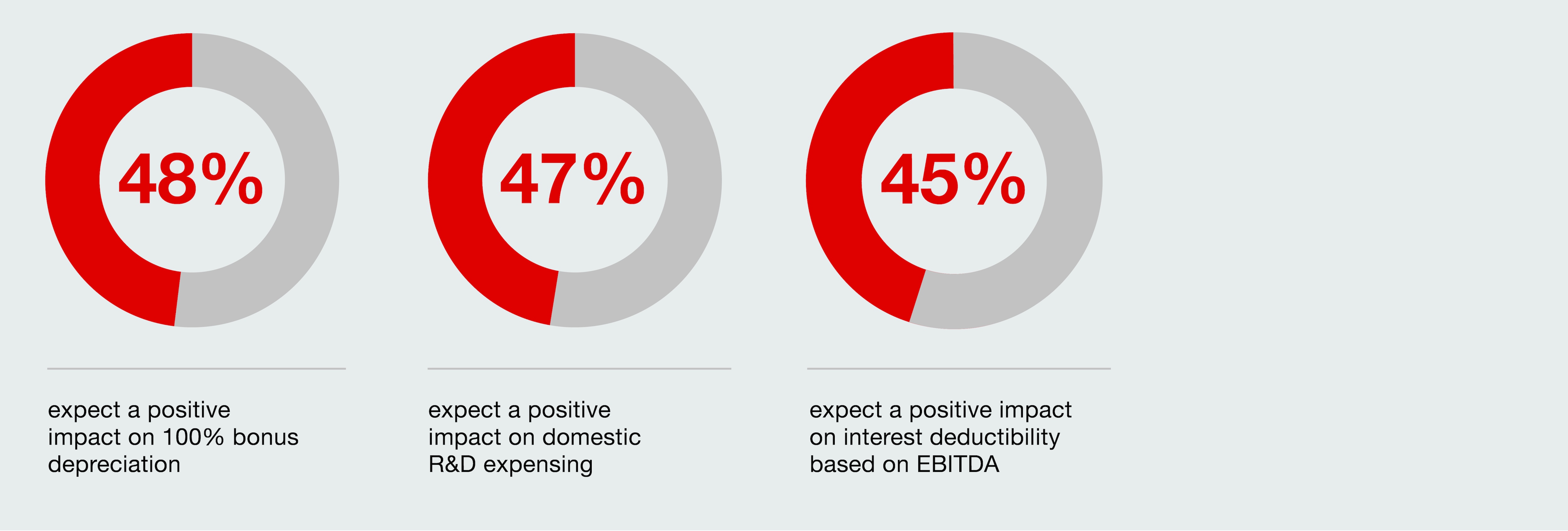

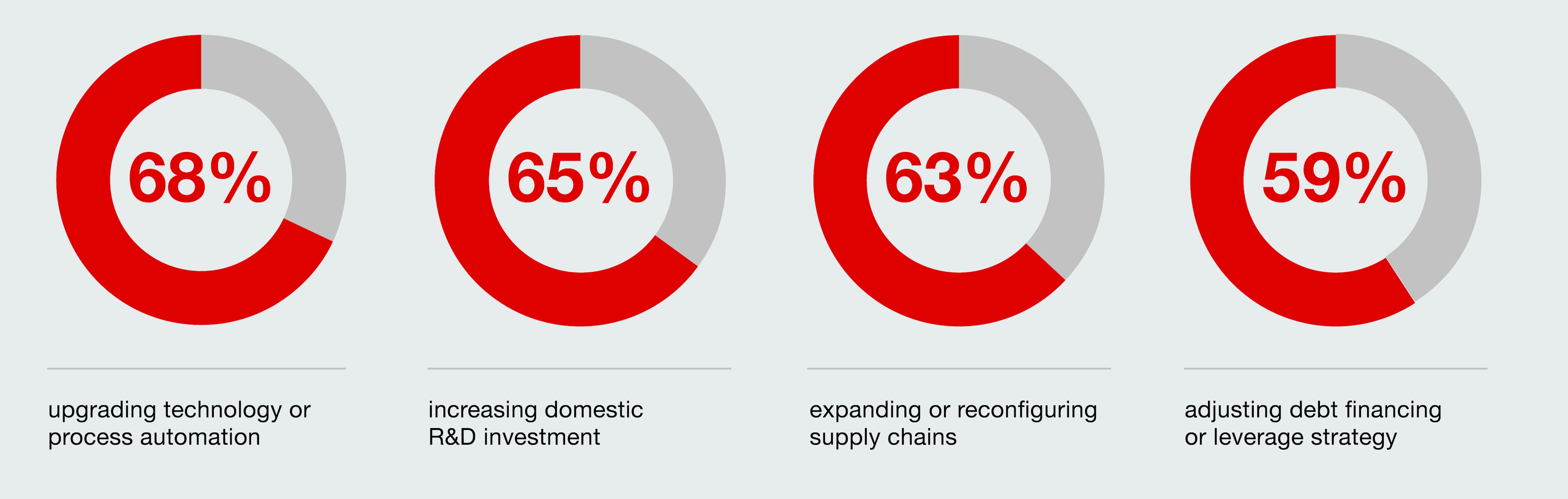

Bonus depreciation and domestic R&D expensing are emerging as the strongest catalysts for growth. Across industries, leaders see these provisions as the clearest path to unlocking liquidity and funding modernization.

Positive sentiment highlights

That confidence comes from experience. Middle market firms have used similar incentives before (during the 2017 Tax Cuts and Jobs Act) to upgrade infrastructure and digitize operations. The new act revives that playbook, allowing companies to accelerate projects that have been sitting on the shelf.

Interest deductibility based on EBITDA also ranks high, offering relief for leveraged companies planning expansion.