Middle Market Sentiment Report: Why leaders are starting 2026 on the front foot

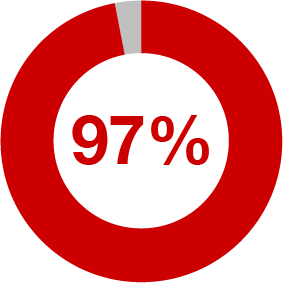

Middle market firms (about 200,000 companies with $10 million to $1 billion in annual revenue) employ roughly 48 million people, account for one-third of U.S. GDP, and help set the pace for the U.S. economy.1 When they lean into growth, the effects are broad.

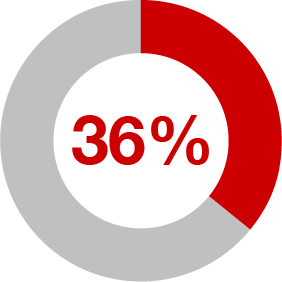

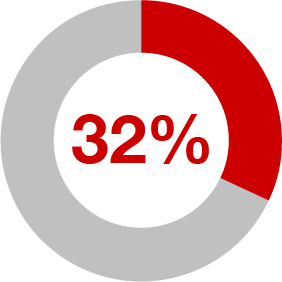

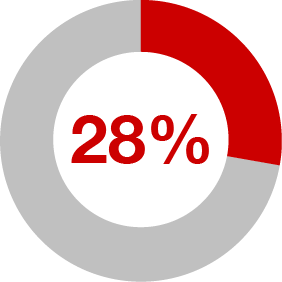

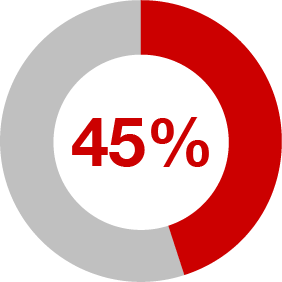

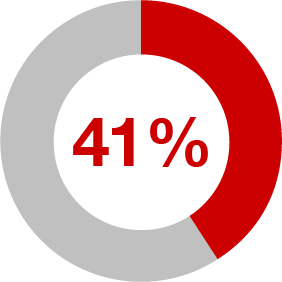

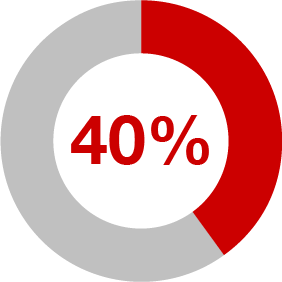

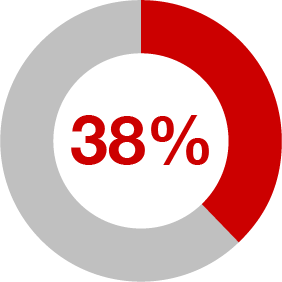

KeyBank’s latest Middle Market Sentiment Survey polled 750 owners and senior executives in November and December 2025. The results point to a middle market entering 2026 on the front foot. Company outlooks are strong, driven by tighter operations, upgraded technology, and steadier teams.

Capital strategies are split between maintaining existing lines and adding capacity, with spending clustered around AI, core systems, and the workforce.

Fraud exposure is easing in aggregate but remains uneven, while M&A activity looks staggered, with buyers acting earlier and sellers later.

Below are six high-level takeaways from the data, each paired with a brief “deep cut” that examines a specific segment.

Download the full report for complete findings.