ChristianaCare, Crozer Health’s Pennsylvania ASC Outpatient Centers

Overview

| Deal Type |

Mergers & Acquisitions |

|---|---|

| Client & Transactional Partners |

ChristianaCare Crozer Health Prospect Medical Holdings, Inc. |

| Our Role |

Buy-Side Advisor |

Summary

Cain Brothers, a division of KeyBanc Capital Markets, served as exclusive financial advisor to ChristianaCare in its acquisition of Crozer Health’s outpatient centers in southeastern Pennsylvania.

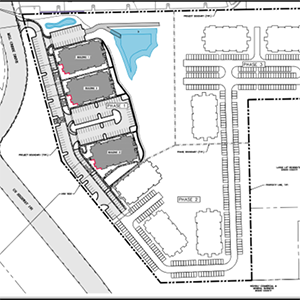

ChristianaCare was the successful bidder in a highly competitive bankruptcy auction to acquire five ambulatory surgery and outpatient centers in Delaware County, Pennsylvania, that were part of the Crozer Health regional health system. Cain Brothers was engaged to serve as financial advisor to assist with financial due diligence, valuation, and bankruptcy auction strategy and tactics due to its deep experience with strategic and tactical M&A advisory. Crozer is subsidiary of Prospect Medical Holdings, which filed for bankruptcy protection. The transaction complements ChristianaCare’s plans for expansion in the service area.

ChristianaCare is a nonprofit regional healthcare system that provides healthcare services to all of Delaware and portions of the bordering counties in Pennsylvania, Maryland, and New Jersey. The system includes an extensive network of primary care and outpatient services, hospitals, and specialized centers of excellence. ChristianaCare reported consolidated revenues of $3.1 billion for the past 12 months ending June 30, 2024.

Crozer Health was one of the largest private hospital systems in Pennsylvania, operating multiple hospitals, primary care clinics, and outpatient centers across the state. Crozer Health was a subsidiary of Prospect Medical Holdings, a California-based national network of hospitals and affiliated medical groups, that filed for Chapter 11 Bankruptcy in January 2025.

KeyBanc Capital Markets Inc., Member FINRA/SIPC, and KeyBank National Association ("KeyBank N.A.") are separate, but affiliated companies. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives.

Securities products and services: Not FDIC Insured • No Bank Guarantee • May Lose Value

Banking products and services are offered by KeyBank N.A. All credit, loan, and leasing products are subject to collateral and/or credit approval terms, conditions, and availability and subject to change.