San Carlos Apache Healthcare Corporation

Overview

| Deal Type |

Debt Capital Markets |

|---|---|

| Size |

$46.25 Million Health System Revenue Bonds, Series 2025 (Taxable) |

| Client & Transactional Partners |

San Carlos Apache Healthcare Corporation, Inc. |

| Our Role |

Sole Initial Purchaser |

Summary

On September 17, 2025, KeyBanc Capital Markets Inc. (KBCM) closed on the Health System Revenue Bonds, Series 2025 (the 2025 Taxable Bonds) for the San Carlos Apache Healthcare Corporation, Inc. (the Corporation).

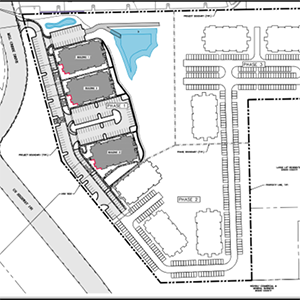

Proceeds of the 2025 Taxable Bonds will be used, along with Corporation equity, to finance a 100-bed long-term care and skilled nursing facility (the Project) on the San Carlos Apache Tribe’s reservation, located ~130 miles east of Phoenix, Arizona. The Project will be adjacent to the Corporation’s 12-bed critical access hospital, enabling members of the San Carlos Apache Tribe (the Tribe) to receive culturally sensitive care and remain close to loved ones.

KBCM assisted the Corporation in securing an ‘A-’ credit rating from Fitch Ratings, supporting the marketing of the 2025 Taxable Bonds. This credit rating is believed to be the first ever for a tribal healthcare operator in the lower 48 states, and one of the highest ever credit ratings for a Native American tribe or tribally chartered corporation. This financing arrangement is distinguished by the absence of a guaranty from any other party and lack of security from sources other than the revenue and assets of the Corporation’s Health System. This structure may help pave the way for other tribes’ health systems and tribally chartered corporations to issue debt secured solely by health system revenues, facilitating future capital projects. Further, the terms of the 2025 Taxable Bonds allow the Corporation to issue additional debt without lender consent if certain financial covenants are met. After seven years, the Bonds can be called at par. Once operational, the Project is eligible to enter a Section 105(l) lease with the Indian Health Services to receive reimbursements for Project costs, including bond debt service.

About San Carlos Apache Healthcare Corporation and the San Carlos Apache Tribe

The San Carlos Apache Healthcare Corporation Inc. or Izeé Baa Gowáh, is a subsidiary economic development enterprise of the Tribe, organized as a nonprofit corporation under the San Carlos Apache Tribe Nonprofit Corporation Act. The Corporation is currently organized and operated solely and exclusively for charitable health care and research purposes, and specifically to support and assist in the provision of holistic and comprehensive hospital and clinical health care services, and for the advancement of the health and social welfare of the Tribe and its members, to assist the Tribe in achieving greater self-sufficiency and self-governance, and to stimulate employment, entrepreneurial, and economic opportunities within the reservation.

The Corporation currently operates a health care campus on approximately 170 acres in Peridot, Arizona, including a 12-medical/surgical bed critical access hospital, a dental clinic, support facilities and employee/provider housing, and a health care campus on approximately 50 acres in Bylas, Arizona, which includes a rural health center. This system provides healthcare for the Tribe, which has an enrolled population of 17,270 members.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives. Banking products and services are offered by KeyBank N.A.

Securities products and services: No Bank Guarantee • May Lose Value

Please read our complete KeyBanc Capital Markets disclosure statement.