Hill Estates

Overview

| Size |

$67.5 Million Bridge to Perm Loan, Acquisition |

|---|

Summary

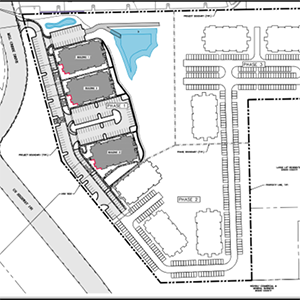

KeyBank Real Estate Capital provided a $67.5 million bridge loan to assist The Hamilton Company with the acquisition of Hill Estates — a 396-unit multifamily residential community located in Belmont, Massachusetts, and two office properties located nearby at a campus off Brighton Street in the town’s easternmost neighborhood. The bridge loan will provide adequate time for the sponsor to best position the asset for a permanent agency financing.

The Hamilton Company will staff an on-site management office and operate all property management and maintenance functions for the 396 units and all common areas. Residents will also have access to the Hamilton’s full range of online tenant services, including online rent payments, maintenance requests, and renter’s insurance.

The two off-site commercial properties will be marketed and sold by The Hamilton Company as they are not part of the core business and revenue model of the Hill Estates residential community. The company plans to make significant capital improvements to the property including the renovation of all units.

“We are thrilled to have played a role in assisting Hamilton grow their robust portfolio through the addition of a legacy multifamily property in a preeminent Boston community,” said T.J. Hussey, relationship manager, KeyBank Real Estate Capital Income Property Group. “We look forward to seeing Hill Estates reach its full potential with the planned capital improvements and operations under Hamilton’s stewardship.”

Founded in 1954 with the acquisition of a six-unit building, The Hamilton Company, owned by Harold Brown, has become one of the largest privately held real estate organizations in New England. The acquisition of the Belmont property enlarges their portfolio of premier residential properties to nearly 6,000 units in the Greater Boston area.

Banking products and services are offered by KeyBank National Association. All credit products are subject to collateral and/or credit approval, terms, conditions, and availability and subject to change.