Turning Stone Resort Casino, LLC

Overview

| Size |

$440 Million Senior Secured Credit Facility |

|---|---|

| Client & Transactional Partners |

Oneida Indian Nation Turning Stone Resort Casino, LLC |

| Our Role |

Left Lead Arranger Joint Bookrunner Administrative Agent |

Summary

On September 22, 2025, KeyBanc Capital Markets Inc. (KBCM) successfully closed the syndication of a $440 million Senior Secured Revolving Credit Facility (the Revolver) for Turning Stone Resort Casino, LLC, a governmental instrumentality of the Oneida Indian Nation. Proceeds of the Revolver will be used to refinance existing indebtedness and fund a major expansion at Turning Stone Resort Casino. KBCM acted as Left Lead Arranger, Joint Bookrunner and Administrative Agent on the transaction.

KBCM’s long-standing relationship with the Nation dates back to the early '90s when the Turning Stone Resort Casino operated a small slot parlor in Central New York. Over the last 30+ years, KBCM has supported Turning Stone Resort Casino’s growth initiatives, helping it become a world-class gaming and resort destination with multiple satellite facilities. This financing marks the fifth syndication completed for Turning Stone Resort Casino since 2016.

About Oneida Indian Nation

The Oneida Indian Nation is a federally recognized sovereign Indian nation with ~1,000 enrolled members. The Nation’s lands are located within a ~300,000-acre reservation across Madison and Oneida Counties in New York and the Nation operates several enterprises across gaming, hospitality, dining, recreation, retail, and other sectors through its component unit, Turning Stone Enterprises, LLC.

About Turning Stone Resort Casino, LLC

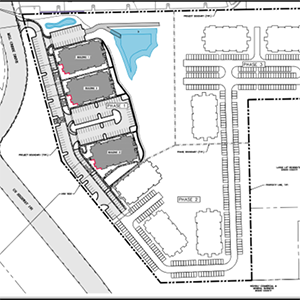

Turning Stone Resort Casino, LLC operates Oneida’s flagship property, Turning Stone Resort Casino – Central New York’s premier gaming and resort destination featuring a 120,000 sq. ft. gaming floor with 1,652 slot machines and 73 table games and world-class amenities including five hotels, two spas, five golf courses, more than 20 dining areas, a showroom, a 5,000-seat arena and several nightlight venues. TSRC also operates gaming activities and related amenities at Point Place Casino, YBR Casino & Sports Book, The Lake House at Sylvan Beach and at six PlayOn locations.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A.