The Mississippi Band of Choctaw Indians

Overview

| Size |

$295 Million Senior Secured Credit Facilities |

|---|---|

| Client & Transactional Partners |

The Mississippi Band of Choctaw Indians |

| Our Role |

Joint Lead Arranger Joint Bookrunner Administrative Agent |

Summary

On August 8, 2025, KeyBanc Capital Markets, Inc. (KBCM) successfully closed the syndication of $295 million Senior Secured Credit Facilities (the Credit Facilities) for the Mississippi Band of Choctaw Indians (d/b/a Choctaw Resort Development Enterprise) (MBCI, or the Tribe). The Credit Facilities consist of a $100 million Revolving Credit Facility, $85 million Term Loan A, and $110 million Delayed Draw Term Loan. The proceeds will be used to refinance existing indebtedness, fund working capital and gaming-related capital expenditures, finance the construction of the new Choctaw Central Middle School and High School Campus, and pay transaction-related fees and expenses.

This transaction represents KBCM’s second left lead syndicated transaction with the Tribe. MBCI selected KBCM based on our longstanding relationship with the Tribe, along with our extensive knowledge and expertise within the Native American Financial Services industry, and successful track record of syndication transactions in the gaming space.

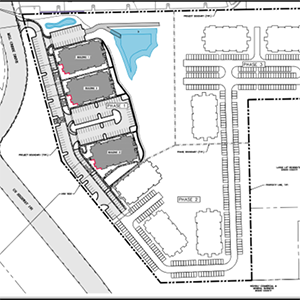

Choctaw Central Middle School and High School Campus

Scheduled to open in Summer 2026, the new Choctaw Central Middle School and High School Campus will feature a two-story academic building to accommodate up to 1,200 students. The campus will include offices for middle school and high school staff, principals’ offices, counselors’ offices, a band hall, cafeteria, dormitory, library, ADA bathrooms, elevators, a two-level arena, and a 2,000-seat turf football field.

Tribe Overview

The Tribe is a sovereign nation and the only federally recognized Tribe in Mississippi, with over 11,000 enrolled members. Tribal lands encompass 35,000 acres across 14 counties, and contain a diversified portfolio of manufacturing, service, retail, gaming, hospitality, and construction enterprises. The Tribe established CRDE in October 1999 for the purpose of managing existing and future gaming and resort operations. The CRDE gaming and hospitality portfolio includes Golden Moon Hotel & Casino, Silver Star Hotel & Casino, Bok Homa Casino, Crystal Sky Travel Plaza, Dancing Rabbit Golf Club, Dancing Rabbit Inn, and Geyser Falls Water Theme Park.

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association ("KeyBank N.A."), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and its licensed securities representatives. Banking products and services are offered by KeyBank N.A.

Securities products and services: No Bank Guarantee • May Lose Value

Please read our complete KeyBanc Capital Markets disclosure statement.