Three Pillars’ $108,295,000 Series 2024 Financing: Active Adult IL Expansion Project

Overview

| Deal Type |

Debt Capital Markets |

|---|---|

| Size |

$108.295 Million Fixed-Rate |

| Client & Transactional Partners |

Three Pillars Senior Living Communities |

| Our Role |

Sole Manager |

Summary

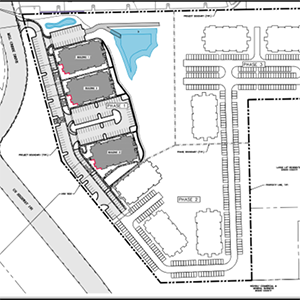

Cain Brothers, a division of KeyBanc Capital Markets, Inc. served as Sole Manager in the public issuance of the $108,295,000 Wisconsin Health and Educational Facilities Authority Revenue Bonds, Series 2024A&B, on behalf of Three Pillars Senior Living Communities, rated “BBB” by Fitch Ratings. The proceeds of the Bonds, together with ~$13 million of equity from Three Pillars, will finance the third phase of its strategic master plan, which is the construction of a new campus with 110 Active Adult units and common areas.

The transaction consisted of ~$46 million of entrance fee bonds split into two series and 35-year fixed-rate bonds sized at ~$63 million. Cain Brothers worked closely with management and the development team to create a financing structure that balanced the goals and objectives of Three Pillars with unique security features attractive to investors, such as funding interest for 39 months. The Bonds received strong investor demand, generating $697 million of total orders from 22 unique accounts (6.4x oversubscribed).

Three Pillars is a nonprofit organization affiliated with the Masonic Grand Lodge of Wisconsin operating a Type-C CCRC in Dousman, WI. Three Pillars has operated for nearly 120 years and provides independent living, assisted living, memory care, short-term rehab, skilled nursing, and a community-based wellness center.

In 2017, leadership formulated a strategic master plan to address its residents’ changing needs and the shifting landscape for staffing and healthcare reimbursement. In 2021, Three Pillars financed the initial phase of the strategic master plan, downsizing its skilled nursing facility by converting its semi-private rooms to private rooms and adding higher-acuity assisted living.

The 2024 Expansion Project represented Three Pillars’ strategic response to challenges faced by single-site life-plan communities industrywide: seniors moving into LPCs older, more frail, and sedentary; persistent labor shortages of clinical labor; inadequate reimbursement from governmental payors, and reliance on non-operating income. The financing enabled Three Pillars to transform its business model to ensure long-term financial sustainability. Equally important, it solidified its value proposition to the local marketplace with a product that appeals to the seniors of today and the future.

Thomas Culhane

KeyBanc Capital Markets is a trade name under which the corporate and investment banking products and services of KeyCorp and its subsidiaries, KeyBanc Capital Markets Inc., member FINRA/SIPC (“KBCMI”), and KeyBank National Association (“KeyBank N.A.”), are marketed. Securities products and services are offered by KeyBanc Capital Markets Inc. and by its licensed securities representatives. Banking products and services are offered by KeyBank N.A.