What Is APY and How Is It Calculated?

When you’re exploring savings or investment accounts, you’ll see the term annual percentage yield (APY). Understanding what APY is and why it's important can help you know what to compare when researching interest-bearing account options.

What is APY?

APY is the amount of interest you can earn over a year on the money you save or invest, including compounding interest. The higher the APY, the more interest you can earn.

What is compound interest and how does it work?

Compound or compounding interest is calculated on the money you deposit and the interest you earn along the way. Interest can compound at different times, including daily, monthly and annually. The more frequently it compounds, the faster you can earn money.

How is APY calculated?

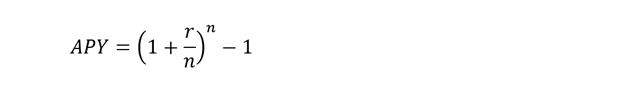

APY is calculated using the formula:

In the formula, (r) represents the interest rate, and (n) represents the number of compounding periods in a year.

Is a high APY good?

Yes, a higher APY is what you want. The APY tells you how much interest you can earn, including how often the interest earned is compounded. When comparing savings and investment accounts, the APY can help you determine which accounts will help you save money faster.

Variable APY vs. Fixed APY

APY can be either fixed or variable. A fixed APY means the interest rate remains constant over a specified period. Fixed APYs provide predictable returns on accounts such as certificates of deposit (CDs). Variable APY means the interest rate can change over time based on market conditions or the policies of the financial institution. Variable APYs are common on savings accounts and money market accounts.

APY Takeaways

An account APY indicates how much interest you can earn, including the frequency of compounding. The power of compounding interest is that you’re earning interest on the cash you deposit and on accumulated interest, to grow your balance even more.

APY is one of many factors to consider when comparing accounts. It’s also helpful to understand account fees, such as monthly maintenance fees and administrative fees, that can decrease your earnings.

Check in On Your Money

We'll talk about your money realities and goals to give you personalized advice and ideas you can start using right away.