What Are My Student Loan Repayment Options?

When it comes to student loans, finding the right repayment plan is no easy task.

But, understanding your options will make it easier to decide when the time comes. First, it helps to know which type of loan you have.

There are two general types of student loans. Private loans are funded by private lenders like a bank, credit union or school. And federal loans are funded by the government. These are much more common, so let’s focus here.

Federal loan repayment plans fall into one of two categories – those with monthly payments based on a percentage of your income and those based on installments with either fixed or regularly increasing payments over time. Each repayment plan is different.

Regardless of which plan you choose, there are some important factors to consider. Your monthly payment is how much you pay toward your loan each month. Depending on which plan you choose, this amount could be higher, lower, or even fluctuate over time. The repayment period is the length of time it will take to pay off your loan. Typically, most loans are repaid anywhere between 10 and 30 years.

All student loans accrue interest. This means you end up paying more money than the amount you initially borrowed. As a general rule of thumb, the sooner you pay off your loan, the less you’ll pay in total interest.

Under special circumstances, some loans are forgiven after a certain period of time or a set number of payments. This isn’t very common, but worth looking in to.

Remember, the repayment plan for each loan option has benefits for specific financial situations, so explore your options thoroughly before choosing one.

To learn more about your repayment options, contact your private lender or a Federal Student Aid representative.

Choosing a student loan repayment plan can be daunting. Understanding your options will make it easier to decide which plan is best for you.

What Are the Types of Loans?

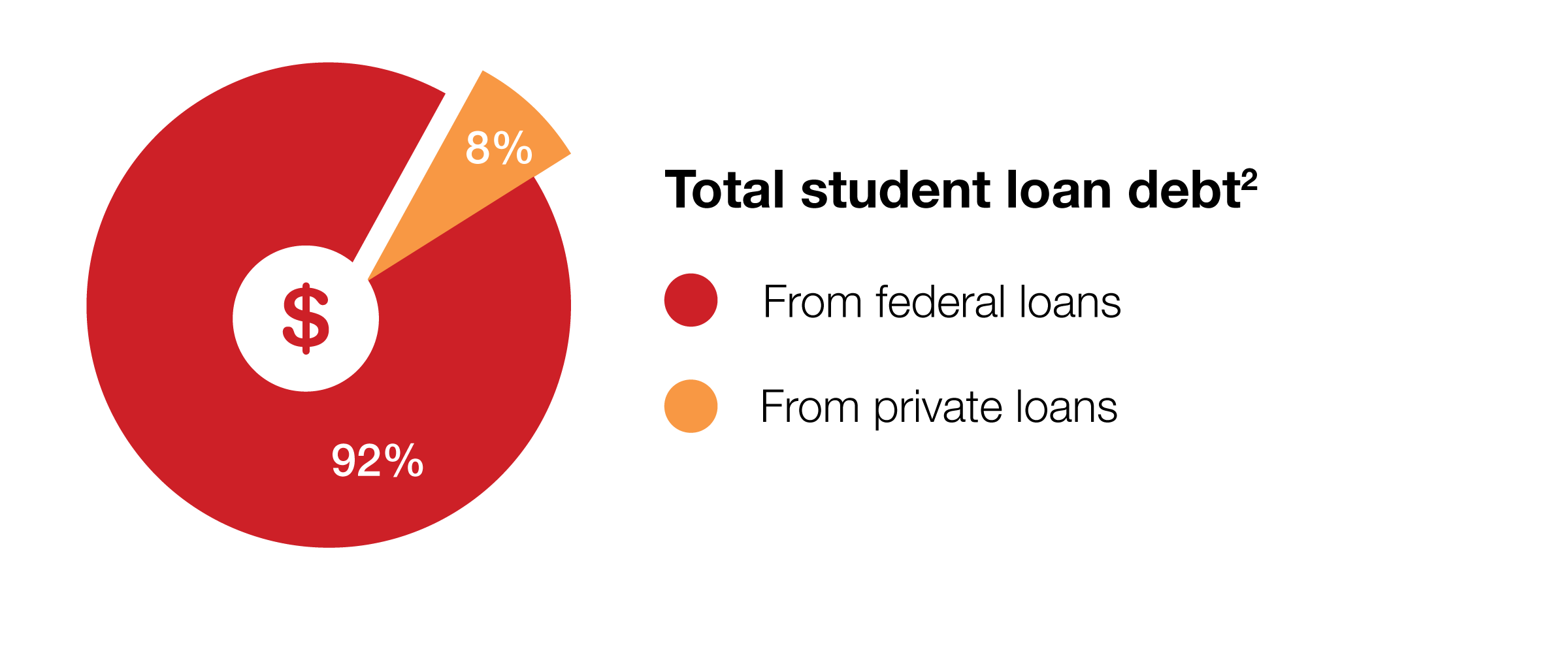

There are two general types of student loans. Federal loans, which are funded by the government, and private loans, which are funded by private lenders like banks or credit unions.1 Private loan repayment plans vary by lender, so we’ll focus on federal loans.

Total student loan debt2

- From Federal loans - 92%

- From private loans - 8%

Two Repayment Categories3

Federal loan repayment plans fall into two categories: those based on fixed or graduated installments, and those driven by income.

For all plans, remember that:

- Repayment includes interest, so the longer the repayment plan, the more interest you’ll pay in total.

- Some loans are forgiven after a certain period of time or number of payments, though you may have to pay income tax on any amount that is forgiven.

- Not all federal loans are eligible for every repayment plan, so make sure you confirm options for your loan.

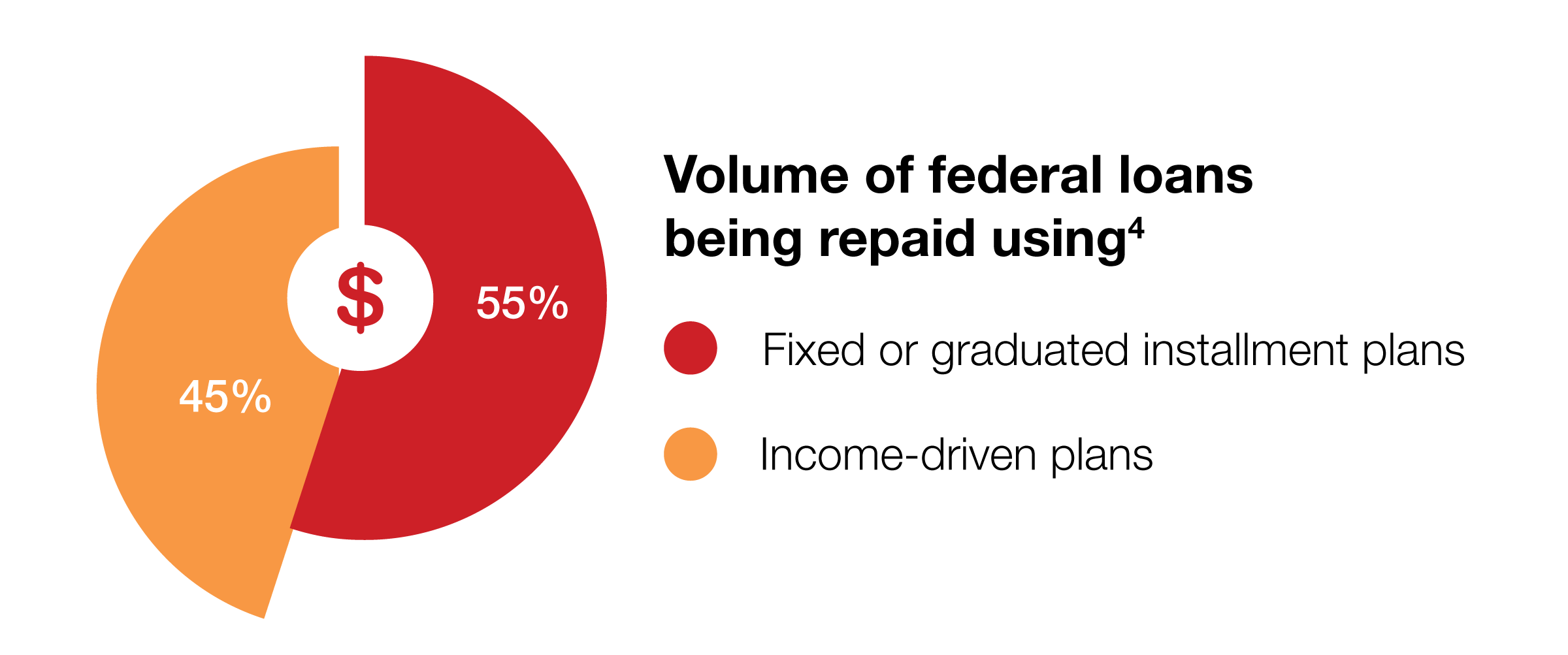

Volume of federal loans being repaid using4

Volume of federal loans being repaid using4

- Fixed or graduated installment plans - 55%

- Income-driven plans - 45%

Fixed or Graduated Installment Repayment Plans

With fixed or graduated installment repayment plans, you typically will repay your loan in full within a specified time, with loan forgiveness not being an option. If you are comfortable with higher monthly payments, the Standard Plan is usually your best choice for lowest total payment over the life of the loan.

Standard Plan

- Repay loan in full with fixed installments

- Repayment period is 10 years (or up to 30 for consolidated loans)

- If you don’t chose another plan, this is your default plan

- You’ll usually pay less over time than under other plans

Graduated Plan

- Repay loan in full with graduated installments

- Installment amounts start lower and increase every few years

- Repayment period is 10 years (or up to 30 for consolidated loans)

- You’ll pay more over time than under the 10-year Standard Plan

Extended Plan

- Repay loan in full with fixed or graduated monthly payments

- Make lower monthly payments over a longer period of time, meaning you’ll pay more over time than with the Standard or Graduated Plans

- Ensures your loan will be paid off within 25 years

Income-Driven Repayment Plans5

Income-driven plans set your monthly payments – recalculated each year – at an affordable amount based on your income and family size, paid over a longer period of time. In general, these plans feature lower monthly payments, higher total interest and loan forgiveness.

Revised Pay as You Earn Repayment Plan (REPAYE)

- Generally pay 10% of your discretionary income every month

- Payments could be more than with the Standard Plan

- Repayment period is 20 years (25 for graduate school loans), after which the remaining balance is forgiven

- You’ll usually pay more over time than under the 10-year Standard Plan

Pay as You Earn Repayment Plan (PAYE)

- Generally pay 10% of your discretionary income every month

- Payments will never be more than with the Standard Plan

- Repayment period is 20 years, after which the remaining balance is forgiven

- You’ll usually pay more over time than under the 10-year Standard Plan

Income-Based Repayment Plan (IBR)

- Generally pay 10% or 15% of your discretionary income every month, depending on when you received your first loan

- Payments will never be more than with the Standard Plan

- Repayment period is 20 or 25 years, after which the remaining balance is forgiven

- You’ll usually pay more over time than under the 10-year Standard Plan

Income-Contingent Repayment Plan (ICR)

- Generally pay the lesser of two options: 20% of your discretionary income, or what you would pay with a fixed payment over 12 years, adjusted for your income

- Repayment period is 25 years, after which the remaining balance is forgiven

- You’ll usually pay more over time than under the 10-year Standard Plan

Your Priorities, Your Plan

Knowing what’s most important to you can help in choosing the right repayment plan.

Want to Learn More?

To learn more about your student loan repayment options, contact your private lender and/or a Federal Student Aid representative. You can also read more about paying off student loans.

This information and recommendations contained herein is compiled from sources deemed reliable, but is not represented to be accurate or complete. In providing this information, neither KeyBank nor its affiliates are acting as your agent or is offering any tax, accounting or legal advice.

By selecting any external link on Key.com, you will leave the KeyBank website and jump to an unaffiliated third-party website that may offer a different privacy policy and level of security. The third party is responsible for website content and system availability. KeyBank does not offer, endorse, recommend or guarantee any product or service available on that entity's website.