What Should You Expect When Buying a House?

Buying a new house can be complicated, but it doesn’t have to be intimidating. These steps will take you from start to close to home sweet home.

The homebuying process may seem scary, but don’t worry! We’ll guide you through it.

First, you’ll need to figure out how much house you can afford. If you’re not sure how much to budget … speak with a mortgage loan officer. They’ll help you create one. They can also explain the different types of loan options, and even get you prequalified. So you’ll know what you can afford and how much to save for a down payment, which can vary depending on the type of loan you apply for.

Next, find a trusted real estate agent. They’ll be your guide on this house hunt. Find your house and then make an offer. A bigger price tag means bigger payments, so keep your budget in mind when choosing a home. Once you’ve agreed on a price, submit a loan application with the help of your loan officer. Then it’s time to schedule your home inspection.

Now your loan officer will be your expert advisor, guiding you through the application process, credit approval, property appraisal, loan approval, and preparing for closing.

Now you’ll finally close on and sign for the home! There’s a lot of paperwork, so start practicing that signature.

You just bought a house and can start focusing on those paint colors.

Step 1: Figure Out How Much House You Can Afford

- When deciding how much to budget, factor in items like your income, expenses, and property taxes for the area in which you are looking.

Find out what you can afford.

It's often beneficial to use a calculator to help plan your budget and finances for your pending conditional approval.

Step 2. Work with a Mortgage Loan Officer (MLO)

- An MLO is your point person for a lender. They can help you create a budget, tell you about loan options, and walk you through the application process.

- They can help you get conditionally approved, so you have an idea of how much you may be able to afford based on your credit score and income.

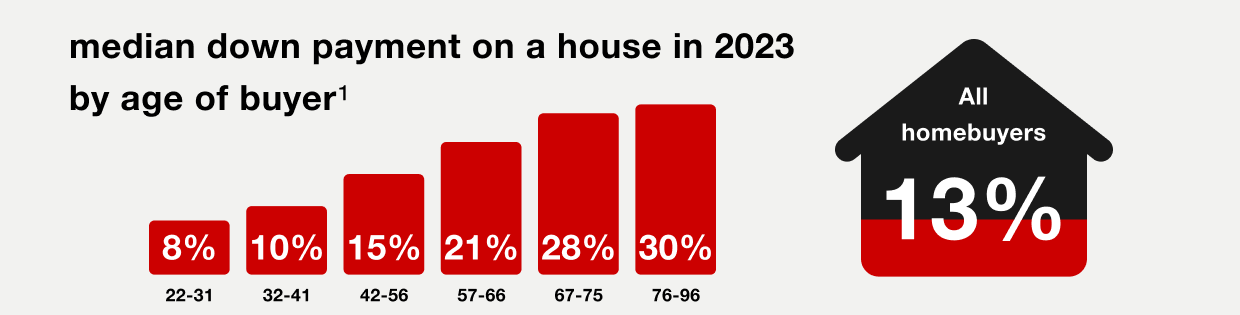

- Your MLO can also help you determine how much of a down payment you should be prepared to bring to closing. Your down payment can vary depending on the type of loan you apply for.

median down payment on a house in 2023 by age of buyer1

8% of homebuyer were between ages 22-31

10% of homebuyer were between ages 32-41

15% of homebuyer were between ages 42-56

21% of homebuyer were between ages 57-66

28% of homebuyer were between ages 67-75

30% of homebuyer were between ages 76-96

Step 3: Locate a Trusted Real Estate Agent

- The agent will serve as your guide on the house hunt.

Step 4: Find Your House and Make an Offer

- Think through what you want in a house, such as home type, size, and location.

- When you find a home you want, make an offer - your agent can help determine a fair price based on a comparative market analysis.

- Remember, the bigger the price tag, the bigger your payments, so always keep your budget in mind.

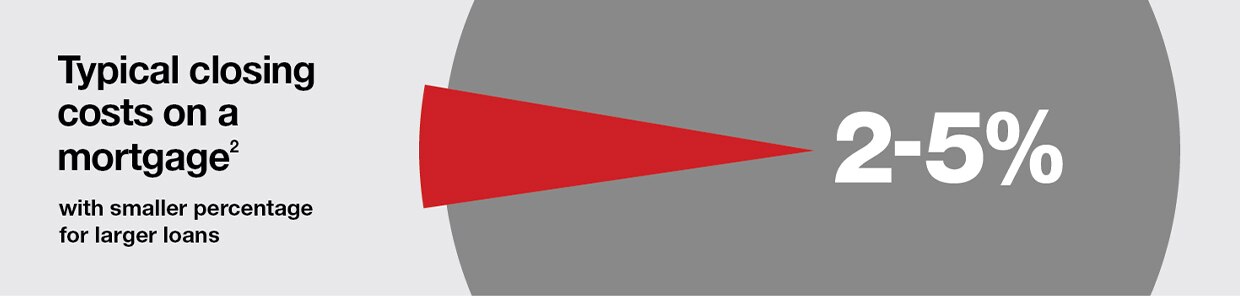

Typical closing costs on a mortgage2 (with a smaller percentage for larger loans): 2-5%

Step 5: Submit a Loan Application

- Offer accepted? Congratulations! Submit a loan application with the help of your mortgage loan officer.

- If you want a home inspection and haven’t crossed it off your list yet, now is a good time to schedule it. There are plenty of independent inspectors who can help you.

- As your expert adviser, your loan officer will lead you through the application process, credit approval, property appraisal, loan approval and preparing for closing.

Step 6: Close and Sign Final Paperwork

- Your bank will work with a title company or attorney to prepare the mortgage note, deed, and title work required to transfer the property.

- You’ll close on the house and sign all of the paperwork related to your loan.

- Once all funds are collected and the contract is verified, you will receive the keys to your new house.

OK, there is actually one more step: make your house a home. This one is all up to you. Enjoy!