Debt Consolidation

If your monthly credit card bills are causing you stress, now might be a good time to consolidate your debt1. Debt consolidation may help you take control of your budget and may help pay down what you owe faster. Generally, it involves taking out a loan to pay-off your current debts that offers a lower interest rate or more favorable repayment terms than your current debts combined. Debt consolidation can eliminate the hassle of juggling multiple credit payments. Plus, the right debt consolidation strategy can improve monthly cash flow as well as save you money over time.

Debt Consolidation

Is debt getting you down? If so, you're not alone. Most people have more debt than they want. If you're looking for a solution - debt consolidation is one common option that can help you get your finances under control.

Take Control by Consolidating Your Debt

POTENTIAL BENEFITS OF DEBT CONSOLIDATION

Save Money

Pay less in interest

Budget More Easily

Take care of bills with one monthly payment

Pay off Debt Faster

Lower your interest to speed up repayment

Save Money

Use a manageable plan to lower the chance of default

Find Your Debt Consolidation Solution

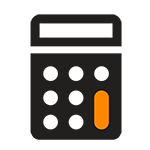

Debt can be a roadblock to any financial journey, especially high-interest debt like credit card balances. Not sure which solution is right for you? Start by exploring the graphic below.

Why Are You Interested in Consolidating Your Debt

Reason 1 | I have multiple loans (with multiple payments) and want to simplify my life

PERSONAL LOAN (image of pen and document)

- Fixed interest rate

- Fixed monthly payments

- One-time payout

LOW-INTEREST CREDIT CARD (image of credit card)

- Variable interest rate

- Flexible payment options

- Ongoing access to credit

HOME EQUITY LOAN (image of house with dollar sign)

Requires Collateral

- Fixed interest rate

- Fixed monthly payments

- One-time payout

HOME EQUITY LINE OF CREDIT (image of house with circling arrows)

Requires Collateral

- Variable interest rate

- Flexible payment options

- Ongoing access to credit

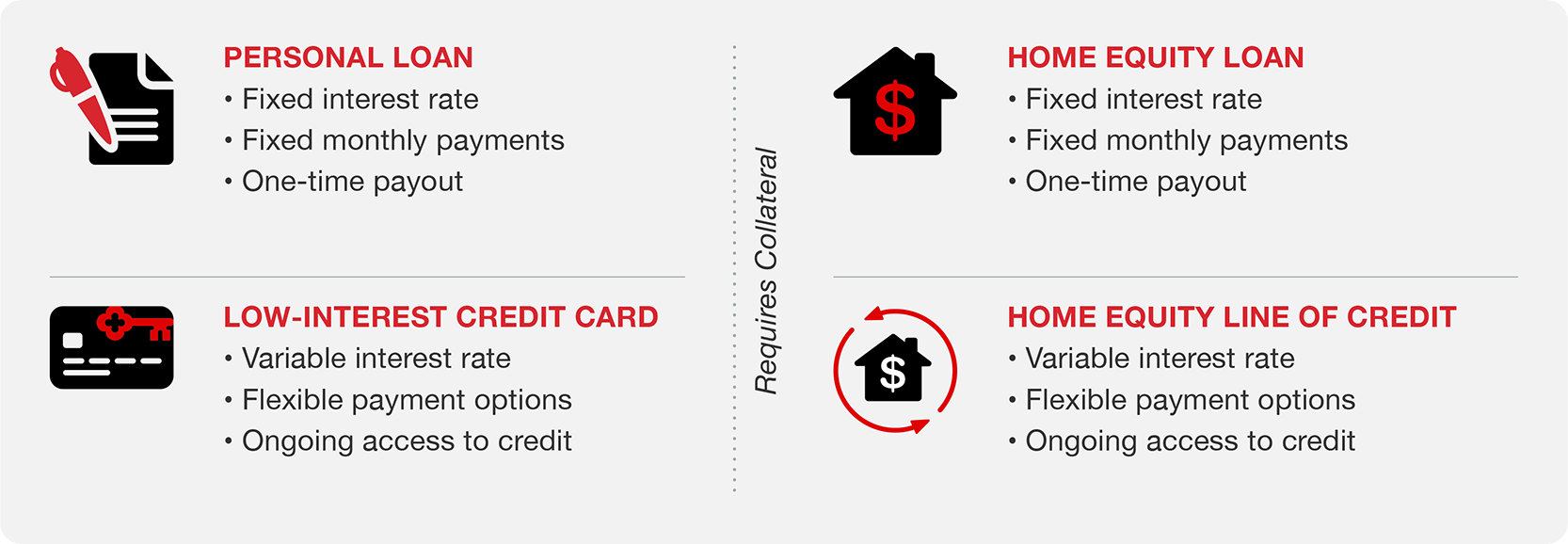

Reason 2 | I'm interested in lowering my interest rate

PERSONAL LOAN (image of pen and document)

- Fixed interest rate

- Fixed monthly payments

- One-time payout

LOW-INTEREST CREDIT CARD (image of credit card)

- Variable interest rate

- Flexible payment options

- Ongoing access to credit

MORTGAGE REFINANCE (image of house)

Requires Collateral

- Fixed interest rate

- Fixed monthly payments

- One-time payout

HOME EQUITY LINE OF CREDIT (image of house with circling arrows)

Requires Collateral

- Variable interest rate

- Flexible payment options

- Ongoing access to credit

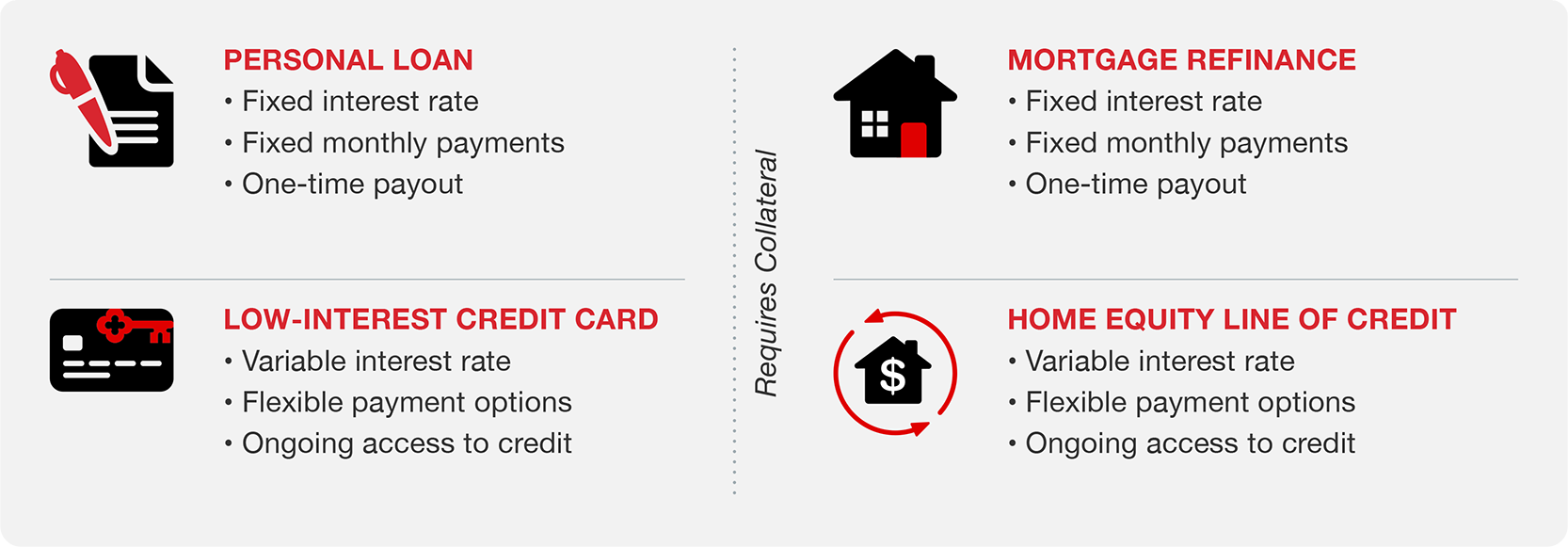

Reason 3 | I'm interested in a 0% balance transfer offer so I can pay down my debt faster

LOW-INTEREST CREDIT CARD (image of credit card)

- Variable interest rate

- Flexible payment options

- Ongoing access to credit

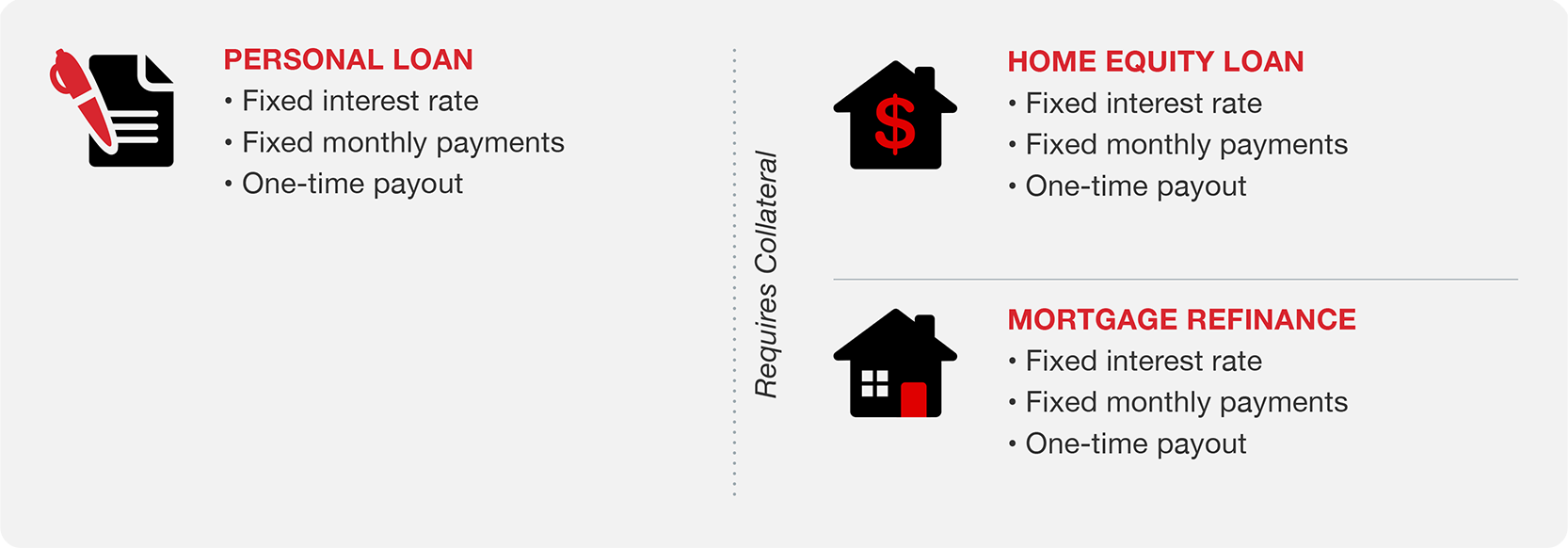

Reason 4 | I'm looking for a lower fixed monthly payment

PERSONAL LOAN (image of pen and document)

- Fixed interest rate

- Fixed monthly payments

- One-time payout

HOME EQUITY LOAN (image of house with dollar sign)

Requires Collateral

- Fixed interest rate

- Fixed monthly payments

- One-time payout

MORTGAGE REFINANCE (image of house)

Requires Collateral

- Fixed interest rate

- Fixed monthly payments

- One-time payout

Have more questions or don't see the proper solution for you?

Schedule a Financial Wellness Review With a Banker

to learn more about consolidating your debt with KeyBank.