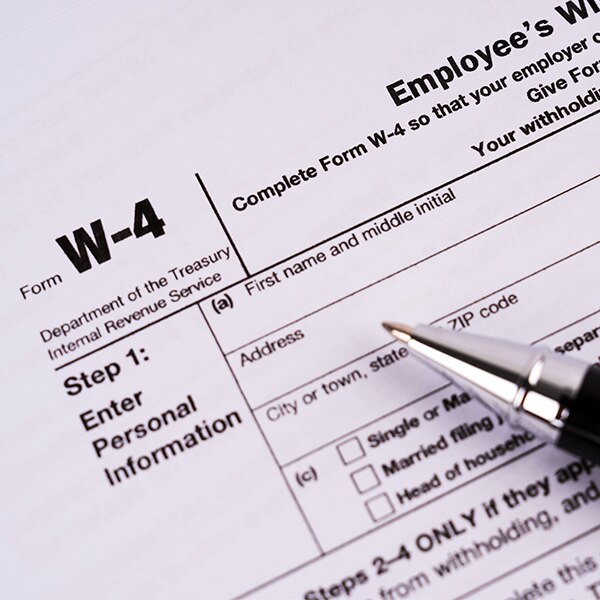

Taxes

Get the strategies and insights you need to make sure you get the most from your money when it comes to paying taxes.

Please consult your tax advisor.

Content provided for informational and educational purposes only and is in no way to be construed as financial, investment, or legal advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal financial issues.