Savings Account FAQs

We have answers to your savings account questions. From interest rates, to fees, to minimum balance requirements — consider this a lesson in savings account basics.

Savings Account Basics

A savings account is a safe place to leave your money while giving your balance the opportunity to grow by earning interest.

Interest rates on savings accounts vary. Your savings account interest rate will be indicated in the product disclosures.

APY is the total amount of interest paid on an account based on the interest rate and frequency of compounding for a 365-day period.

Compound interest is the process of adding interest on the principal balance plus previously earned interest. Compound interest is commonly thought of as “interest on interest."

KeyBank Savings Account Information

To apply for a KeyBank savings account, you'll need the following:

- Your Social Security number

- One valid form of primary identification (like a driver's license, valid passport, or government-issued ID with photo and signature)

- The minimum opening deposit required (this amount varies depending on the account)

Online account opening is available for opening individually owned accounts. To open a KeyBank savings account online, you need to be a U.S. citizen who is at least 18 years old and a resident of Alaska, Colorado, Connecticut, Idaho, Indiana, Maine, Massachusetts, Michigan, New York, Ohio, Oregon, Pennsylvania, Utah, Vermont, or Washington.

If you plan to open a joint account or don't meet one of the requirements for online account opening, please visit a branch to apply for a savings account.

If you don't meet one of these requirements, please visit a branch to apply for a savings account.

The minimum deposit required to open a savings account varies depending on the type of savings account.

There is no limit to the number of savings accounts that you have. Keep in mind, though, that each account will likely have its own fees and requirements.

Some savings accounts at Key have maintenance fees, while some are fee free. For a list of which accounts have fees and which don’t, visit the Compare Savings Account page.

There are several ways to withdraw money or make payments from KeyBank savings accounts. You can make withdrawals at a branch, by ATM, or by transferring money to other accounts. You can also make payments using Bill Pay in online banking and the mobile app, Zelle® or, for accounts with check privileges, by writing paper checks.

Interest is earned on a savings account based on the balance in the account and the interest rate. Typically, interest is compounded daily or monthly and added to the account balance.

Yes. KeyBank savings accounts are FDIC insured.

There are five ways to view your activity:

- In the monthly or quarterly statement you opt to receive by mail or through email

- Sign on to online banking1

- Use KeyBank’s mobile app2 (must be enrolled in online banking)

- Call 1-800-KEY2YOU® (1-800-539-2968)

- Visit a branch

There are two ways to add an authorized signer:

- Visit a branch

- Call 1-800-KEY2YOU® (1-800-539-2968) and follow the voice prompts. Dial 711 for TTY/TRS.

Depending on the type of deposit you make at a KeyBank branch, ATM, or on a mobile device, your funds may be available the next business day.

There are a few exceptions that may delay your funds’ availability, including deposits for a large dollar amount or to a KeyBank savings account that has been open fewer than 30 days.

When making a deposit, be sure you understand when your money will be available so you can avoid overdrafts and fees. If you have any questions about your funds’ availability, talk to a KeyBank representative by phone or at one of our branches.

KeyBank uses state-of-the-art technology to ensure your personal and account information are kept safe. We deliver a secure environment through a variety of methods, such as encryption, firewalls and customer-controlled passwords.

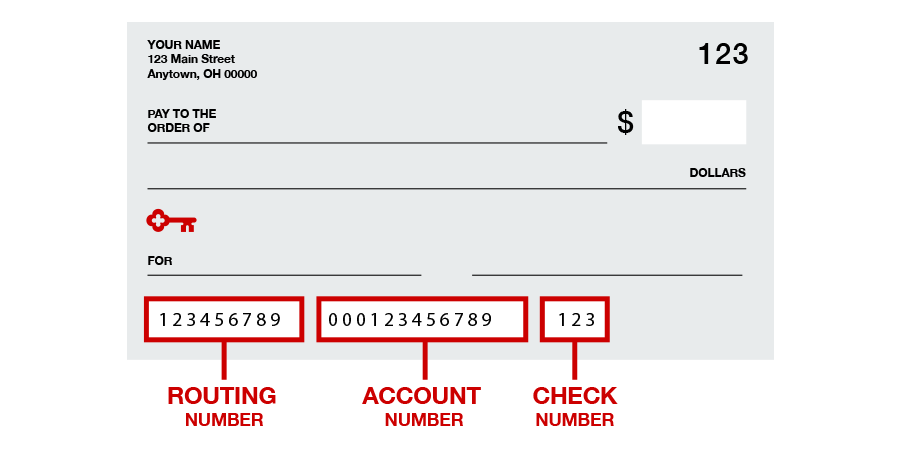

Unlimited check writing is available with KeyBank money market accounts, including the Key Select Money Market Savings® account.

Easily order checks for your money market account in online and mobile banking, directly with our preferred check provider Harland Clarke3 by calling 1-800-355-8123 (dial 711 for TTY/TRS), or stop in your local KeyBank branch.

KeyBank savings and money market accounts, including Key Active Saver® and Key Select Money Market Savings, can be used for overdraft protection, but health savings accounts (HSA) cannot.

KeyBank offers detailed information about overdraft fees and options available to avoid them. We're also always available to discuss the best option for you.

Subject to terms and conditions in Service Agreement.

Message and Data rates may apply from your wireless carrier.

KeyCorp is not affiliated with, maintained by, or in any way officially connected with Harland Clarke or any of its business units.