skip the bank line.

Visit more than 40,000 KeyBank ATMs and Allpoint® ATMs nationwide.

Our ATMs are designed with features that allow you to set your personal preferences and the ability to request different denominations to let you get what you need quickly and get back to your day. With convenient locations, strict security, and features that save time, KeyBank ATMs help you bank on the go.

KeyBank ATM Features

Features vary between ATMs, and all options are shown on the machine’s main menu.

- Set preferences (Remember Me)

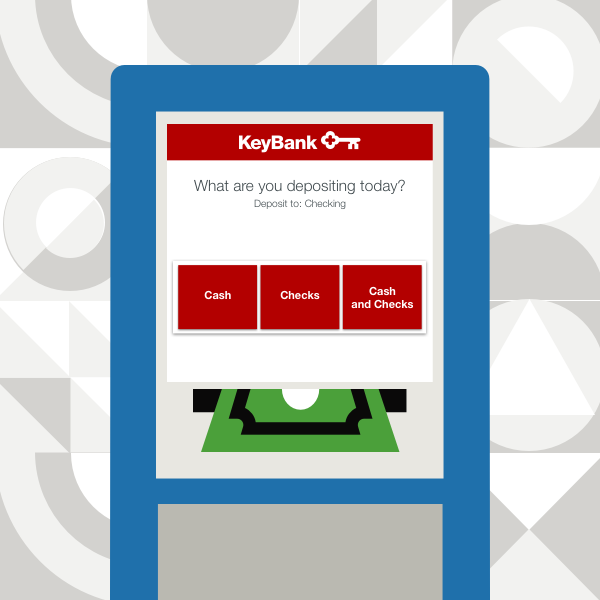

- Deposit checks and cash

- Withdraw cash in specific denominations, such as $5, $20, and $50

- Check balances

- Get mini statements

- Change your ATM PIN

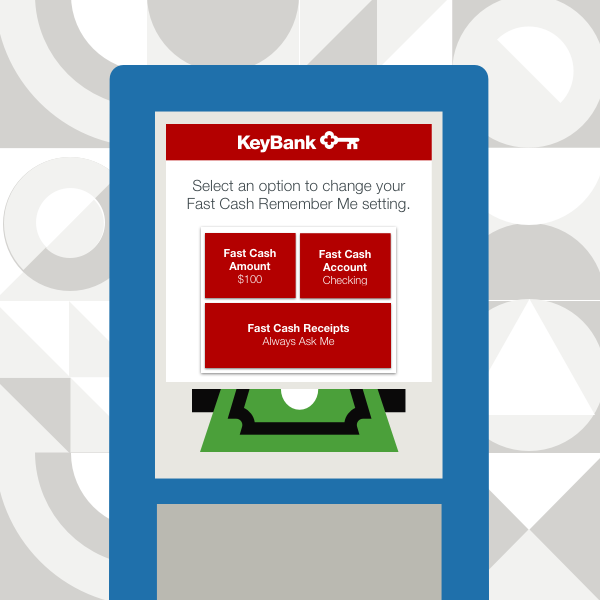

Set Your Preferences on KeyBank ATMs

Save time with Remember Me.

Select Remember Me on the main menu of KeyBank ATMs to set your profile on every preference-enabled KeyBank ATM.

- Use Remember Me to set your Preferences for the following: English, Español, and Français

- Use Remember Me to set your "Fast Cash" withdrawal amount

- When using the "Fast Cash" feature, if the amount is $500 or less, you will receive $20 bills. If it's above $500, you will receive $50 bills unless you adjust your settings.

Plus, choose to include images of your deposited checks or the denominations of your cash receipts.

Frequently Asked Questions about KeyBank and Allpoint ATMs

To reduce the amount of clients accidentally leaving their card at the ATM, we’ve upgraded our program to return the client’s card to them before they receive their cash.

To keep your card in the machine during multiple transactions, make your deposits and/or balance inquiries first and then withdraw your cash.

If the account is a KeyBank account, contact KeyBank and file a dispute. Call us at the contact center 1-800-KEY2YOU. Dial 711 for TTY/TRS.

- If the card is a non-KeyBank card or a closed/inactive KeyBank card, it will be destroyed for the client’s security.

- If the client’s active card is captured at a branch ATM during regular business hours, the client can enter the branch and show identification to retrieve the card. Otherwise, the client can call the branch or the branch will make contact with them. Once contact is made, the client will have one week to pick up the card. After the one-week period, if the card hasn’t been picked up, it will be destroyed for the client’s security.

- If the client’s card is captured at a KeyBank ATM that is not serviced by a branch, the card will be destroyed for the client’s security and the cardholder will have to contact KeyBank to order a new card.

Gently tap on the screen graphics / buttons to make your selections.

The function keys on both sides of the screen are no longer functional.

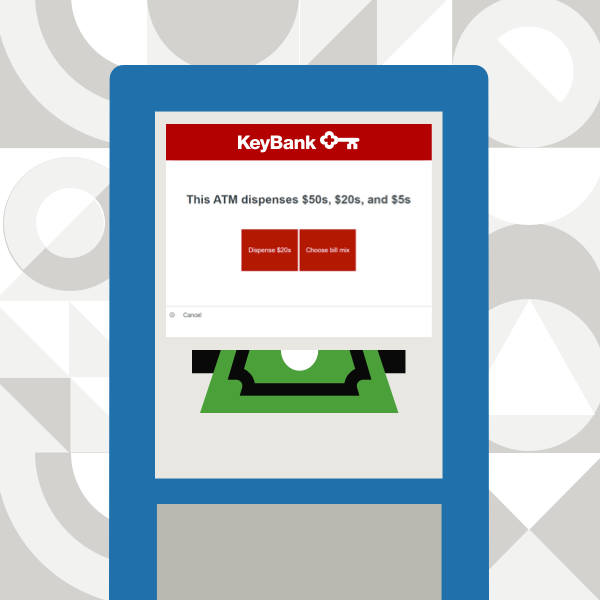

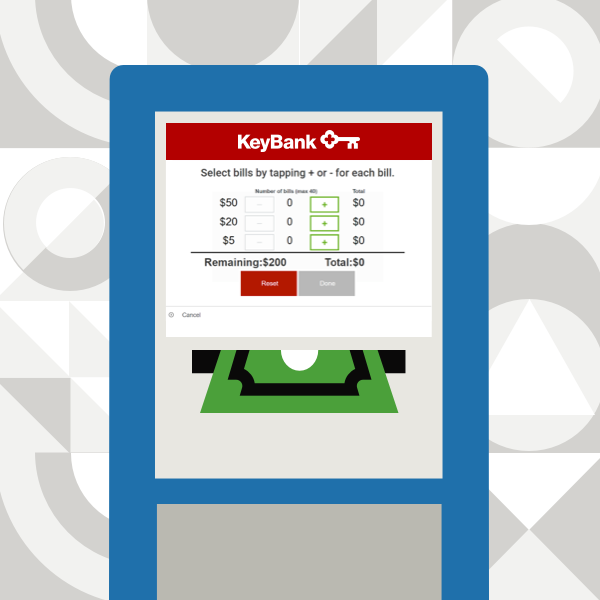

When making a regular cash withdrawal from a KeyBank ATM, you will need to decide if you’d like the ATM to distribute your cash or select your own denominations. If you opt to select your denominations, you’ll land on the denomination selection screen where you will see +/- icons next to the denomination amount. The selection starts at $0.

You can adjust the amount of bills you would like using the +/- icons next to each denomination amount, choosing how much of each denomination you’d like to receive.

There is a 40 bill limit for cash withdrawals.

Cash deposits made at KeyBank ATMs before 7:00 p.m. local time on business days will be available the same day.

Check deposits made at KeyBank ATMs before 7:00 p.m. local time on business days will have $100 available the same day and the rest the following day. Longer delays may apply.

Deposits made at KeyBank ATMs after 7:00 p.m. on business days or anytime on weekends or legal holidays will be considered deposited on the next business day.

You can deposit up to 30 checks at a time.

You can deposit up to 50 bills at a time.

Allpoint is a network of 55,000 ATMs worldwide through which eligible KeyBank checking account clients will have surcharge-free access. The network has 40,000 locations throughout the United States and 15,000 additional ATMs in Canada, Mexico, Puerto Rico, United Kingdom, and Australia. KeyBank international ATM fees and ATM operator surcharges are not charged for transactions at Allpoint network ATMs outside of the United States, but foreign currency transaction fees may apply.

Allpoint ATMs are found in many popular retail stores — places you already know and shop at every day. Allpoint ATMs can be found at Target, Walgreens, CVS, Speedway, and many other convenient locations. In fact, one out of every 12 ATMs in the US participates.

With the exception of the KeyBank Hassle-Free Account®, all clients in KeyBank’s personal checking products are eligible for Allpoint when they use their KeyBank Debit Mastercard®. Savings, Business, and Hassle-Free accounts are not eligible for Allpoint.

Review the first six digits of your KeyBank Debit Mastercard®. Eligible cards start with:

544927

544928

553680

559439

If your card is not on this list and you are interested in surcharge-free access to the Allpoint network, visit a local branch for a Key Financial Wellness Review®.

To make a surcharge-free withdrawal or balance inquiry, you must use your KeyBank Debit Mastercard®. ATM cards do not have surcharge-free access to Allpoint ATMs.

Many Allpoint ATMs look like they are operated by other banks or credit unions, however all ATMs listed on the locator are part of the Allpoint network and are surcharge free for eligible debit cards. Just look for the Allpoint sticker on the lower part of the ATM.

Just look for the Allpoint sticker on the lower part of the ATM or use the ATM locator on key.com to find a surcharge-free ATM in the US near you. To locate international ATMs, please visit https://www.allpointnetwork.com/locator.aspx.

Yes, for account security, KeyBank does have daily withdrawal limits based on the card you use. The limits are set as default or standard limits, but to give you the flexibility you need with your money, you are able to easily request a different daily maximum ATM or purchase limit. (At some ATMs, maximum withdrawal amounts may be limited due to machine constraints, and multiple transactions may be necessary to obtain the total amount you want.)

To find the standard limits for your card, visit Agreements and Disclosures.

Yes, your total daily withdrawals and purchases may not exceed the daily limit for a single card, even if the card is connected to more than one account.

You can request to increase the limit on your card by visiting any KeyBank branch. In emergency situations, you may request an increase by calling 1-800-KEY2YOU® (1-800-539-2968).

Dial 711 for TTY/TRS.

KeyBank Member FDIC

No surcharge at KeyBank ATMs. No surcharge at Allpoint ATMs when using your KeyBank debit card on an eligible account type. With the exception of the KeyBank Hassle-Free Account®, all clients in KeyBank’s personal checking products are eligible for Allpoint when they use their KeyBank Debit Mastercard®. Savings, Business and Hassle-Free accounts are not eligible for Allpoint.