Get Started with Personal Banking Products & Services

Get Started with Personal Banking Products & Services

Every day, banking brings out the best in all of us.

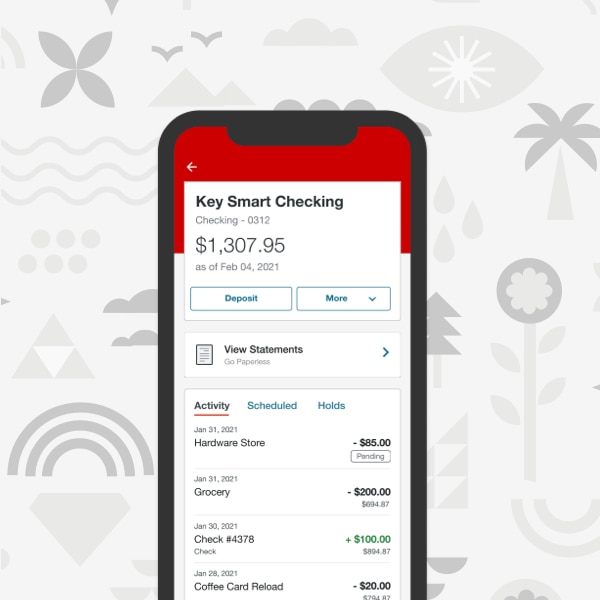

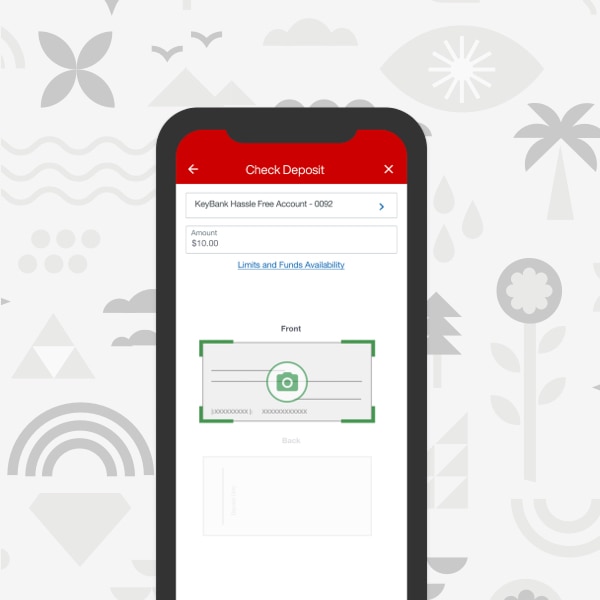

Tips and How-To's

The path to financial wellness starts here.

KeyBank

Loans

Mortgages

NMLS# 399797. Equal Housing Lender.