checking accounts for students

Start college strong with the right bank account.

Make managing money as stress free as possible with the right checking account for students. Follow these simple tips to stay on top of your budget, so more of your money stays where it matters most — with you.

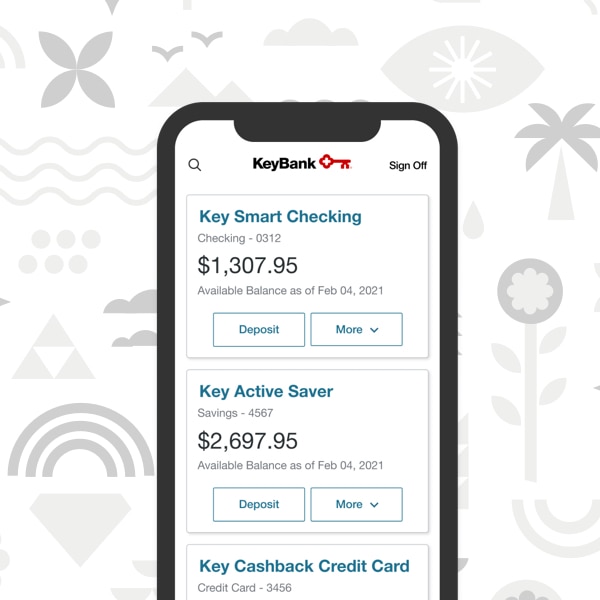

Open a checking account that's great for students.

- No monthly maintenance fee, no minimum balance

- Paper checks and every digital feature

-

$0

Monthly Maintenance Fee

-

No

Interest Bearing

- No monthly maintenance fee, no minimum balance

-

$0

Monthly Maintenance Fee

-

No

Interest Bearing

Budgeting Tips for Students

Frequently Asked Questions About KeyBank Student Checking Accounts

You must be 18 or older to open a bank account on your own. If you’re under 18, please visit a KeyBank branch with your parent or guardian.

The minimum opening deposit required to open a Key Smart Checking account or a KeyBank Hassle-Free Account is $10.

Yes. Key Smart Checking account holders aren’t subject to ATM fees at any KeyBank or AllPoint® ATMs nationwide with your KeyBank Debit Mastercard®.

You can access any KeyBank ATM at no charge using your KeyBank debit card. There is a $3 fee for using a non-KeyBank ATM in the United States and $5 fee for ATMs outside of the United States.

Subject to terms and conditions in Service Agreement.

Message and Data rates may apply from your wireless carrier.

Immediate Funds℠ is available in the KeyBank mobile app and will only appear as an option for eligible mobile check deposits. You will also have the option for a standard deposit at no charge. The Immediate Funds fee is 2% of the deposit amount, with a minimum fee of $2.

Immediate Funds requests made after 11:00 p.m. ET will have immediate funds availability for ATM withdrawal and point-of-sale transactions. However, it will take until the next business day for the funds to be available to cover overdrafts or other transaction types. For more information, review our Funds Availability Policy.